What stage startup offers the best risk-reward tradeoff?

Joining a startup comes with all kinds of perks:

- - The excitement of seeing your work make a real, direct impact

- - The chance to throw rocket fuel on your career growth & wear lots of different hats

- - Getting to be part of conversations you’d be nowhere near at a FAANG company

But let’s face it. The reason you’re probably thinking about joining a startup is how much you can earn if it exits. Traditional (and accurate) wisdom says the earlier you go, the more money you’ll make on a successful exit—and the more likely you’ll end up with nothing. The later you go, the smaller your eventual check—but the higher the odds the startup actually does exit.

So what’s the optimal trade-off between risk and reward?

To answer that question, we took a close look at 14,000 U.S.-based startups that raised in 2014 or 2015. We picked those years because enough time has passed that most of these startups have had ample time to exit. ‘Exit’ is defined here as an IPO or acquisition where the startup exited for more money than it raised.

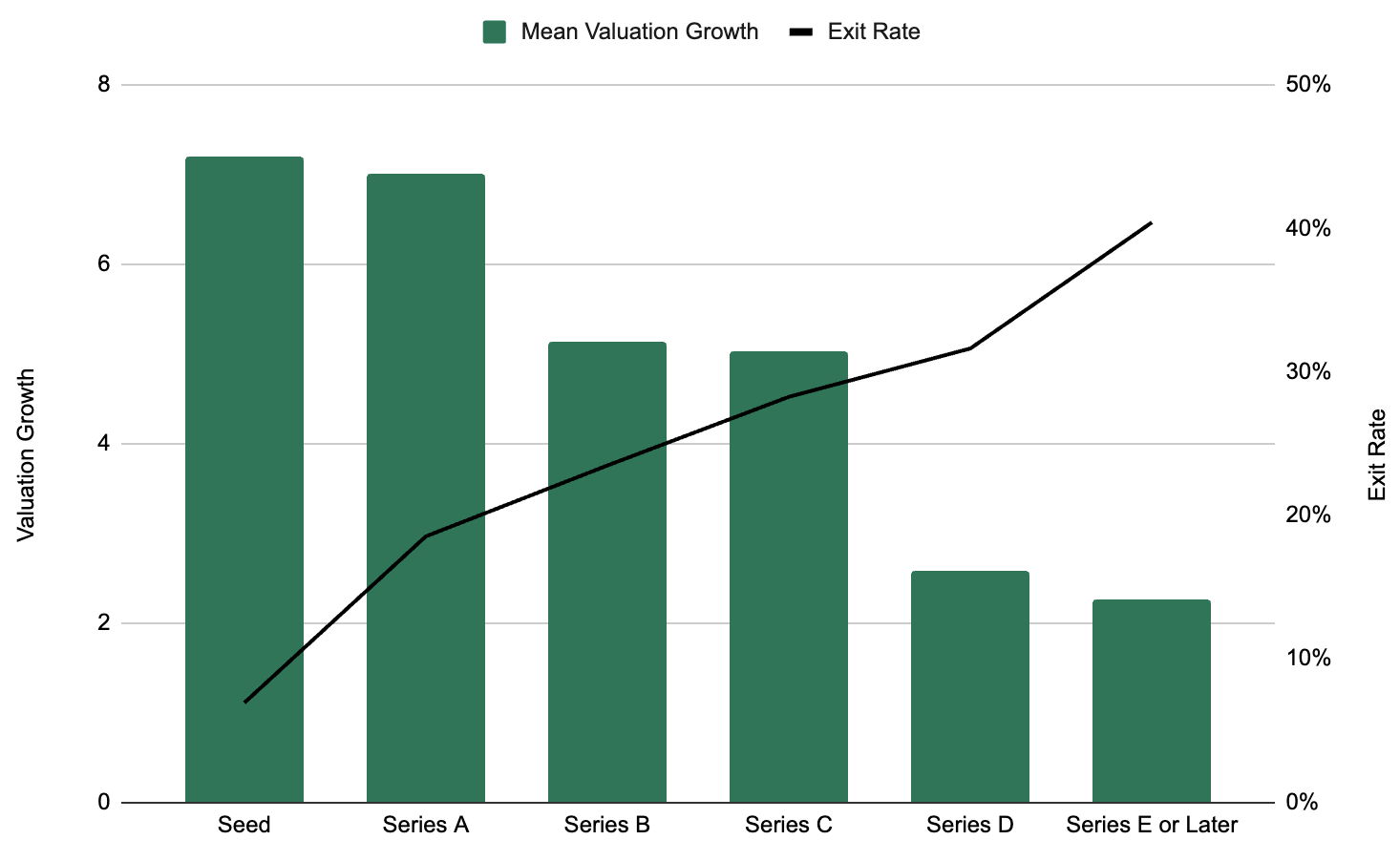

It doesn’t pay to play it safe

It’s no surprise that the more rounds of funding a startup raises, the more likely it is to exit. 19% of startups that raise a Series A round ultimately exit for more than the amount they raised, compared to 40% of companies that make it to Series E or later.

| U.S.-based startups that raised in 2014 or 2015 and exited for more than they raised | ||||

|---|---|---|---|---|

| Stage | Companies | Exited | Exit Rate | Mean Valuation Growth |

| Seed | 7570 | 525 | 6.9% | 7.21 |

| Series A | 3188 | 591 | 18.5% | 7.01 |

| Series B | 1414 | 332 | 23.5% | 5.13 |

| Series C | 704 | 199 | 28.3% | 5.03 |

| Series D | 354 | 112 | 31.6% | 2.59 |

| Series E or later | 329 | 133 | 40.4% | 2.26 |

Note: These numbers are a bit low because some of the companies that will likely exit from this batch have not yet exited. Stripe, for example, raised its Series C in 2014 but still has not gone public or been acquired.

Unfortunately, joining a later-stage startup doesn’t mean a golden ticket to life-changing equity. Usually, the later you join, the smaller your equity value when the startup exits. This has two causes: 1) employees that join in the early rounds are typically given outsized equity grants to compensate them for the risk they are taking 2) earlier stage companies typically grow their valuation more. In the Mean Valuation Growth column above, we show how much companies grew their valuation between the funding round on the left and the eventual exit. We took dilution from fundraising into account when calculating mean valuation growth but were unable to take dilution from employee option pools into account.

A couple examples from our recent analyses on Loom and Instacart:

- - Instacart employees that joined at Series C or beyond likely would’ve made more money if they’d joined a FAANG company or gotten paid in all-cash and invested that money into the market.

- - Loom employees’ that joined at Series A and B raked in massive returns, and those who joined at Series C got a roughly market-average return (when looking at similar companies).

Remember that, as an employee, you’re an investor. If you join a startup early (seed to Series C), you’re taking on a venture capital level of risk—with the potential for venture capital-level rewards. If you join from Series D and beyond, you’re closer to a growth investor than a venture capitalist. When you join late, you should evaluate whether the company truly has major growth ahead of it (like SpaceX, Uber, and Stripe all did) or not.

If you want to join a startup late and you’re not sure whether it has growth potential, you may be better-off at a publicly-traded company where you have access to liquidity.

Joining a seed-stage startup isn’t a golden ticket, either

Joining a late-stage startup likely isn’t ideal if you want to make off with a life-changing bag—but neither is joining a seed-stage startup.

Why? Because you’re not going to make any money on the equity you hold in a startup if the startup doesn’t exit, and just 6.9% of seed-stage startups ever exit for more than they raised.

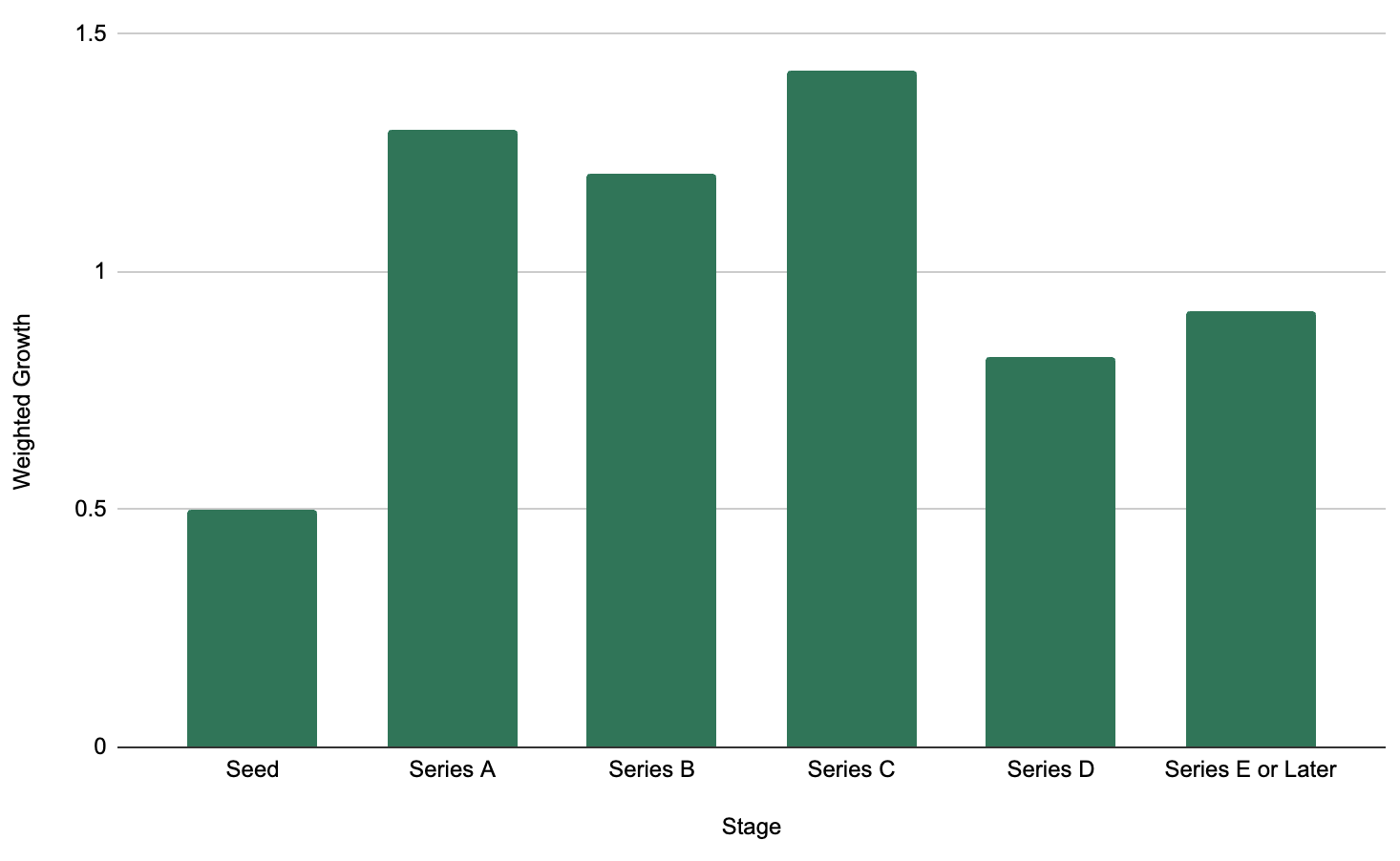

Seed-stage startups become even less appealing when you take a metric we call ‘weighted growth’ into account, defined as the following:

Weighted Growth = [mean valuation growth] x [% that exited for more than they raised]

Seed-stage startups had a weighted growth of 0.5—the worst of every stage we analyzed.

| U.S.-based startups that raised in 2014 or 2015 and exited for more than they raised | |||||

|---|---|---|---|---|---|

| Stage | Companies | Exited | Exit Rate | Mean Valuation Growth | Weighted Growth |

| Seed | 7570 | 525 | 6.9% | 7.21 | .5 |

| Series A | 3188 | 591 | 18.5% | 7.01 | 1.3 |

| Series B | 1414 | 332 | 23.5% | 5.13 | 1.2 |

| Series C | 704 | 199 | 28.3% | 5.03 | 1.4 |

| Series D | 354 | 112 | 31.6% | 2.59 | .82 |

| Series E or later | 329 | 133 | 40.4% | 2.26 | .92 |

When we ran that calculation on Series A through E and higher, we found that Series C startups had the highest weighted growth number (1.42), closely followed by Series A (1.3) and Series B (1.2).

Series C startups were also the most likely to exit of the three (28.3% compared to 18.5% for Series A and 23.5% for Series B).

Joining early, especially at the seed stage, means joining a company that is highly unlikely to exit. If you want the best chances of your equity in a startup being worth more than the tradeoffs you’ll be making to get it, the data says to join a startup at Series C, A, or B (in that order).

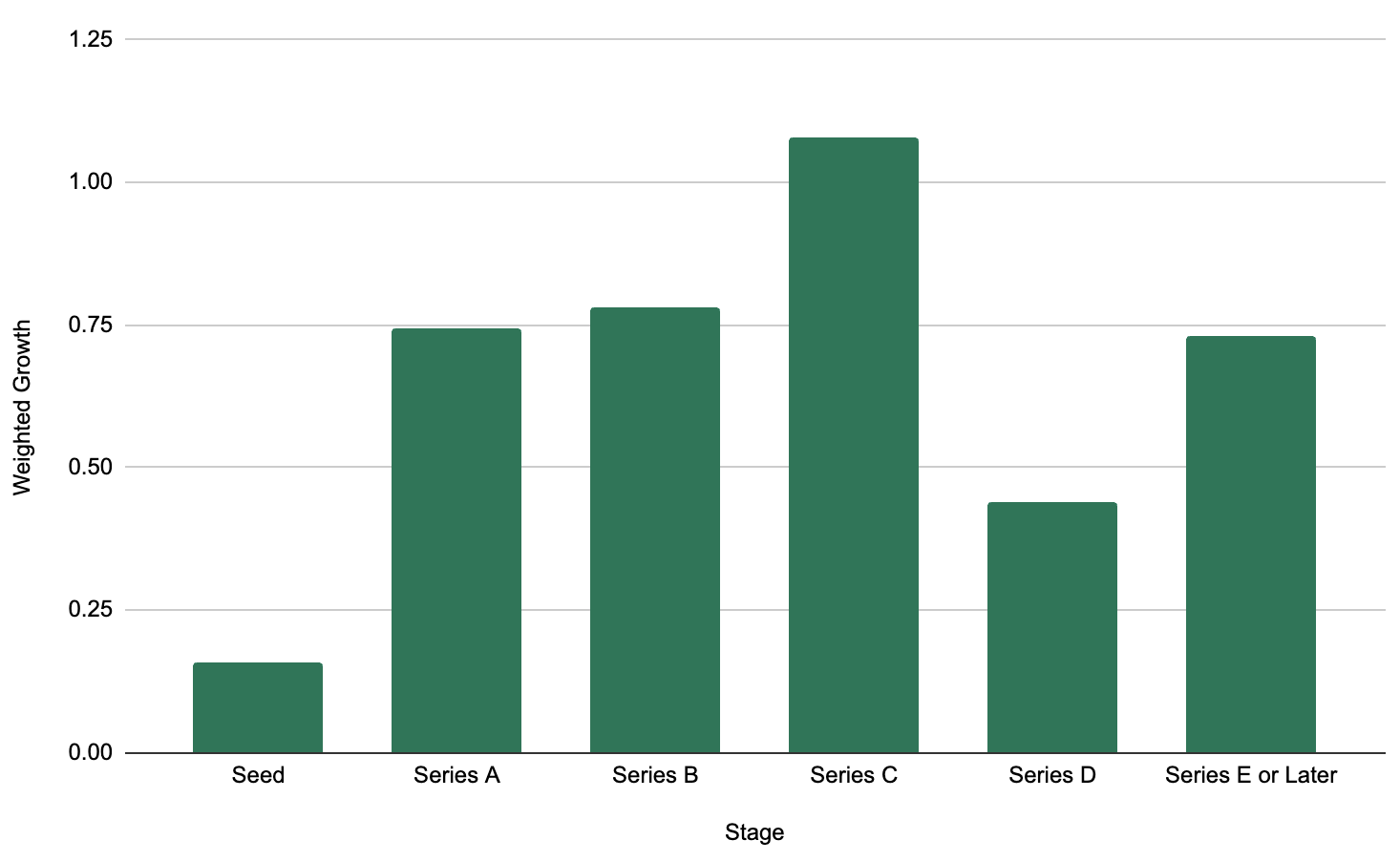

How big of an exit do you want?

Whether or not the startup you work at eventually exits is one thing. How much it exits for is a different piece entirely. In a perfect world, you probably want your startup to exit for >$500M.

Here’s why:

- - Assuming you joined early enough to get a decent piece of equity, an exit over $500M will result in a life-changing paycheck. An “I-technically-don’t-have-to-work-again” paycheck.

- - Companies that exit over $500M become the brand names that stand out on a resume. People who currently have “joined Loom at Series A” on their resume, for example, tend to have a big advantage over those who don’t.

- - A company that gets big enough to exit for more than $500M will also usually have an A-list alumni network. This is useful for lots of reasons (like new job opportunities, or a network of talent and investors to tap into if you start your own company).

Here’s the data on startups that exited for more than $500M:

| U.S.-based startups that raised in 2014 or 2015 and exited for more than $500M | |||||

|---|---|---|---|---|---|

| Stage | Companies | Exited | Exit Rate | Mean Valuation Growth | Weighted Growth |

| Seed | 7570 | 29 | 0.4% | 41.4 | 0.16 |

| Series A | 3188 | 91 | 2.9% | 26.0 | 0.74 |

| Series B | 1414 | 83 | 5.9% | 13.3 | 0.78 |

| Series C | 704 | 72 | 10.2% | 10.5 | 1.08 |

| Series D | 354 | 45 | 12.7% | 3.5 | 0.44 |

| Series E or later | 329 | 78 | 23.7% | 3.1 | 0.73 |

The exit rate goes down significantly across all stages, but the mean valuation growth goes way up. This make sense, as exits over $500M are lucrative but rare.

You’ll notice Series C also had the highest weighted growth number, this time by a significant margin, for startups that exit for over $500M.

For the best chance of joining a startup that’ll exit at a jaw-dropping price—which’ll both net you a big check and propel your career and network forward—look again to Series C (or B, or A).

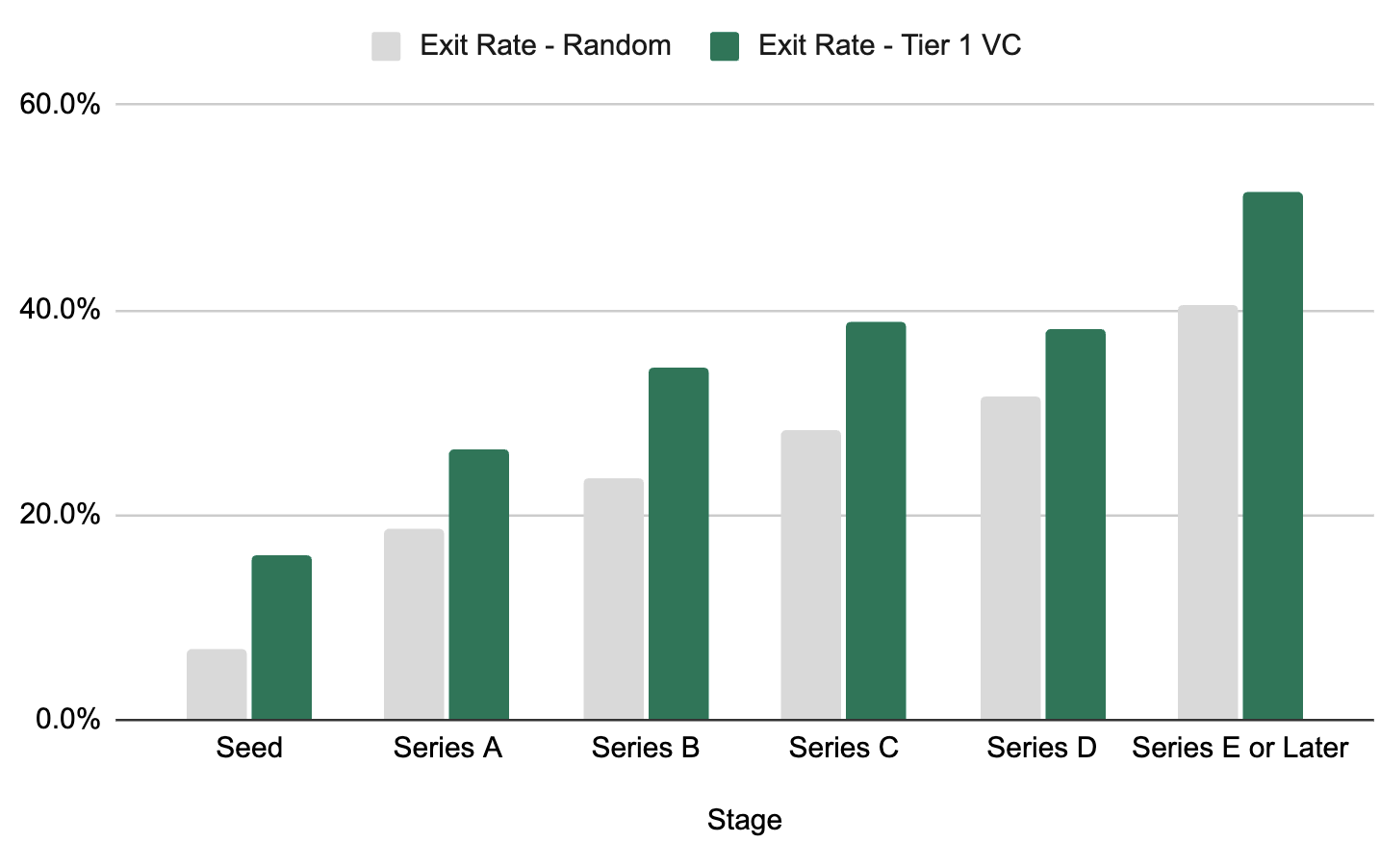

There are clear ways to increase your odds

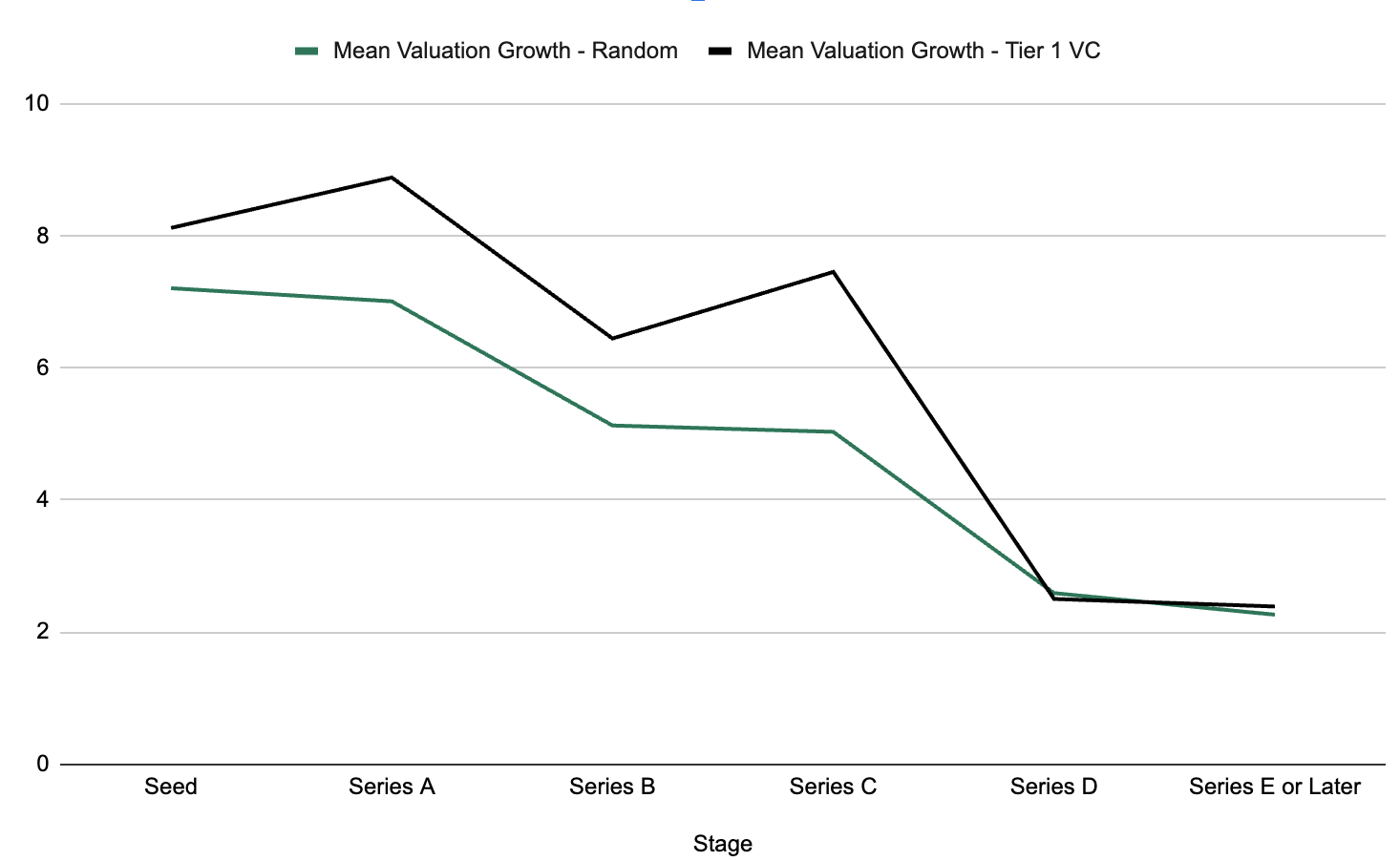

These numbers above are for a blind dart throw: picking any startup at that stage. But we know there are ways to increase your odds—like throwing a dart at a pool of startups backed by top VCs. We compared the exit rate of startups backed by 30 top VCs with the exit rate of all startups:

Here’s that data in more detail:

| U.S.-based startups that raised from a Tier 1 investor in 2014 or 2015 and exited for more than they raised | |||||

|---|---|---|---|---|---|

| Stage | Companies | Exited | Exit Rate | Mean Valuation Growth | Weighted Growth |

| Seed | 418 | 67 | 16.0% | 8.13 | 1.30 |

| Series A | 493 | 130 | 26.4% | 8.89 | 2.34 |

| Series B | 345 | 119 | 34.5% | 6.45 | 2.22 |

| Series C | 203 | 79 | 38.9% | 7.46 | 2.90 |

| Series D | 118 | 45 | 38.1% | 2.50 | 0.95 |

| Series E or later | 136 | 70 | 51.5% | 2.39 | 1.23 |

Note: The sample size is much lower here than in the other sections, which may be responsible for some of the oddities like the Series C valuation growth being higher than Series B.

Notice that these numbers are significantly higher across the board compared to the numbers we found when we look at a data set of all startups. It’s interesting that Tier 1 investors boost valuation growth at the early stages, but that gap converges at the growth stages:

Following a Tier 1 investor is just one signal of many that you can use to boost your odds of finding a winner. Last week, we wrote about four metrics that you can use to determine the health of your current startup. If you combine these with Tier 1 investors–say, looking for Sequoia-backed startups that haven’t done layoffs, or Kleiner Perkins portfolio companies that are in the top decile of headcount growth, you can improve your odds much more. At Prospect, we take a quantitative approach to this to give you the very best odds of finding a company that will exit.

Recap: What stage startup should you join?

- - Joining at Series C may give you an ideal combination of risk and reward. Series C startups had the highest weighted growth in our analysis, followed by Series B and A.

- - At Series D and beyond, you may be taking a serious amount of risk for little upside. Many people who join startups at this stage would be better off joining a publicly-traded company and either getting paid in all-cash or in cash & public stock.

- - Joining at the seed stage is high risk-high reward. Just 1 in 4,000 seed-stage startups in our analysis exited for more than $500M, and just 7 in 100 exited for more than they raised. You’re taking a lot of risk at the seed stage—though you have the most upside here.

- - If your startup is backed by a top VC firm, your odds go up significantly. Numbers jumped across the board when we looked at startups backed by 30 top VCs.

As a startup employee, you don’t have a portfolio like a VC might—but you can still build one chronologically. If you’d like to make better-educated decisions about the startups you join, you may want to check out Prospect. We help you analyze startups like an investor and find the highest-potential startups to commit your career to.

Ready for your next big career move?

Prospect curates the most comprehensive list of top performing startups. Find the next Stripe, Airbnb, or Coinbase today.