Find startups worth betting your career on

Prospect uses the same data VCs use to give you an independent projection of what your equity is likely to be worth. Find the next Stripe, Airbnb, or Coinbase today.

Why join these companies specifically?

Prospect uses the same models and data sources as the best data-driven investors (e.g. Coatue, Tribe) to help candidates find the highest potential startups to join.

We have built and backtested a predictive model that considers a wide range of inputs, including fundraising and valuation data, investor quality, growth metrics like web traffic and app downloads, secondary market prices, founder and employee backgrounds, and more. In some cases, we get traction metrics directly from the companies themselves. We then cross-checked the model’s outputs by surveying top investors and operators in these industries.

We help you find the next breakout hit and avoid the buzzy unicorn that doesn’t have the traction to back up its valuation.

We've looked at every company in the US that has raised from a top 500 VC. We distilled our list to the top 2%.

Used for job searches by employees from top tech startups

Model Performance So Far

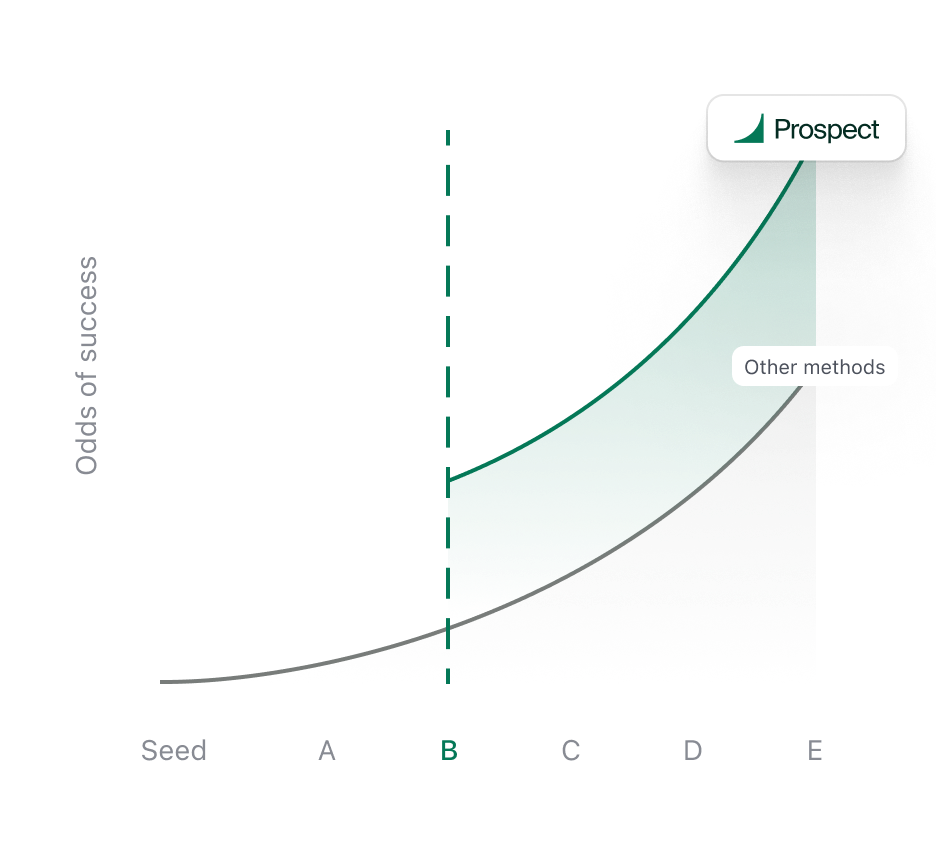

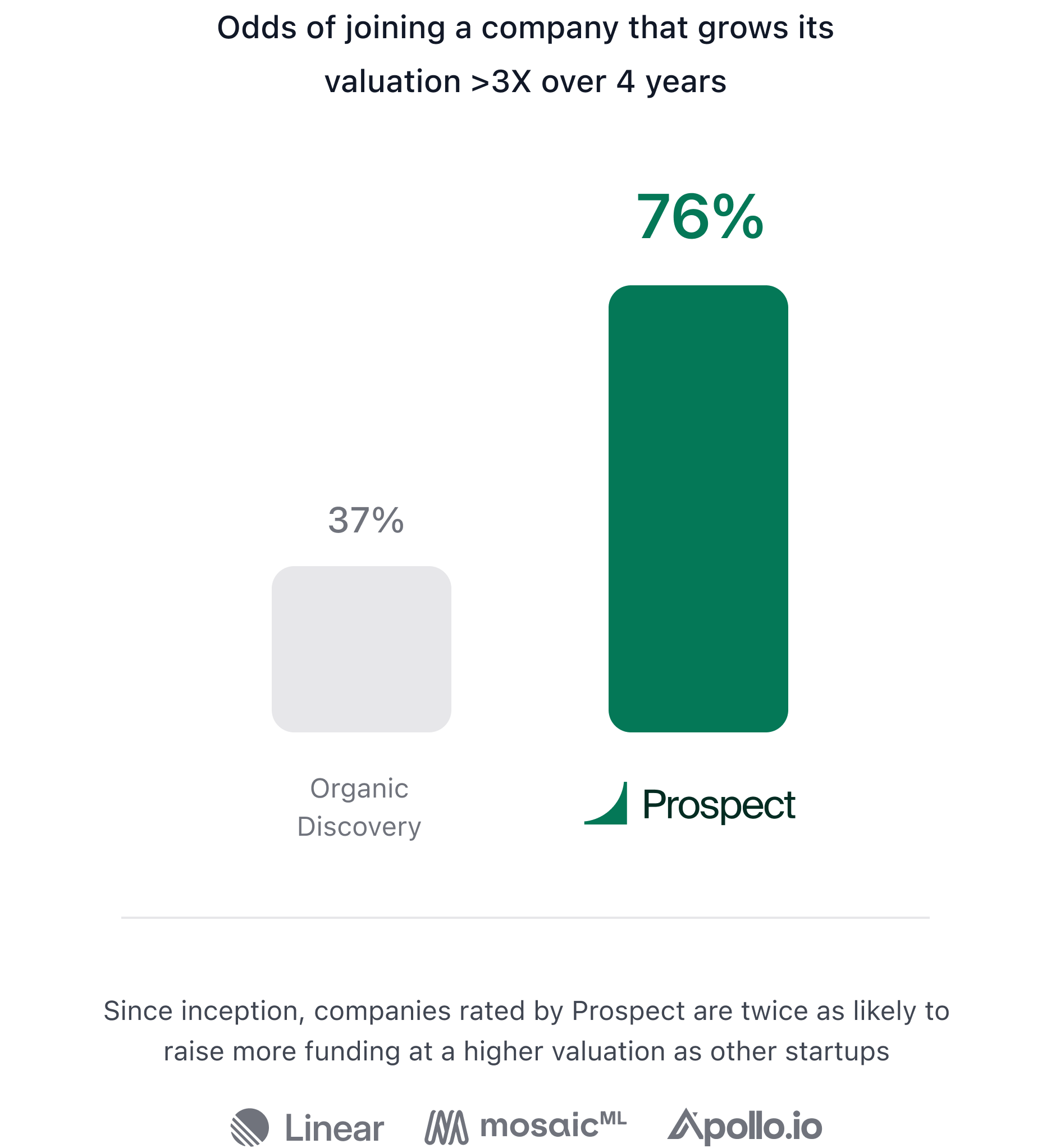

No one–not even the best investors–can tell you exactly what will happen in four years. But we can take a systematic approach that drastically improves your odds of joining a winning company.

Our model is already increasing employees’ odds as it is picking winners (47 markups so far) and avoiding losers.

These odds are high enough that you can take a few swings and get a hit that will dramatically accelerate your career development and earnings.

Ready for your next big career move?

Prospect curates the most comprehensive list of top performing startups. Find the next Stripe, Airbnb, or Coinbase today.

“My last job search was overwhelming and time consuming, but Prospect made it super easy to cut through the noise. I quickly found growing startups fighting climate change in the Bay Area and am so happy at Watershed.”

“I’m not a VC so it’s tough to know which startups are actually going to do well. Using Prospect turned confusing job offers into a no brainer decision.”

We Know Startups

Our CEO and cofounder Billy Gallagher was the first reporter to cover Snapchat and DoorDash, analyzing their potential as a writer at TechCrunch. He then worked on the investing team at Khosla Ventures, a top venture capital firm. He used the same approach we have built into Prospect for a job search in 2018, ultimately joining Rippling (a Sequoia-backed startup valued at $11 billion) as employee 34.

Our founding data scientist, Ben Martin, built pricing models at Opendoor, a publicly traded real estate company that uses data science to predict home prices.

Our technical cofounder, Sam Kennedy, was the founding engineer at Osmind, a Series B startup backed by top investors including Y Combinator and General Catalyst.

We are backed by top investors like Construct Capital and founders and CEOs from Anduril, Ramp, and Wealthfront.

How private markets are different for employees

In the public markets, anyone can buy a stock and there is substantial competition to find winners.

In the private markets, venture capital funds aim to return >3X invested capital (much higher for early stage funds) to their investors, driven by their best performing companies. VCs need to pay a higher price than the last round to invest, but as an employee you do not.

As an employee, you can see the most recent traction data since the last round when you decide to join, increasing your odds that you’re working at–and earning equity in–one of the winning companies.