Loom’s acquisition was a home run for most employees

Last Thursday, Loom sold for $975M to Atlassian in one of the largest startup exits of 2023.

Not everyone viewed it so favorably, though. Because Loom’s acquisition price ($975M) was lower than what their Series C valued them at ($1.5B), there’s some negative sentiment about the acquisition. For example, TechCrunch’s piece notes that Joe Thomas, Loom’s CEO, simply “tried to put a positive spin” on the acquisition.

But digging into the numbers, Loom’s acquisition was a home run for almost everyone involved.

Would it have been a good idea to join Loom?

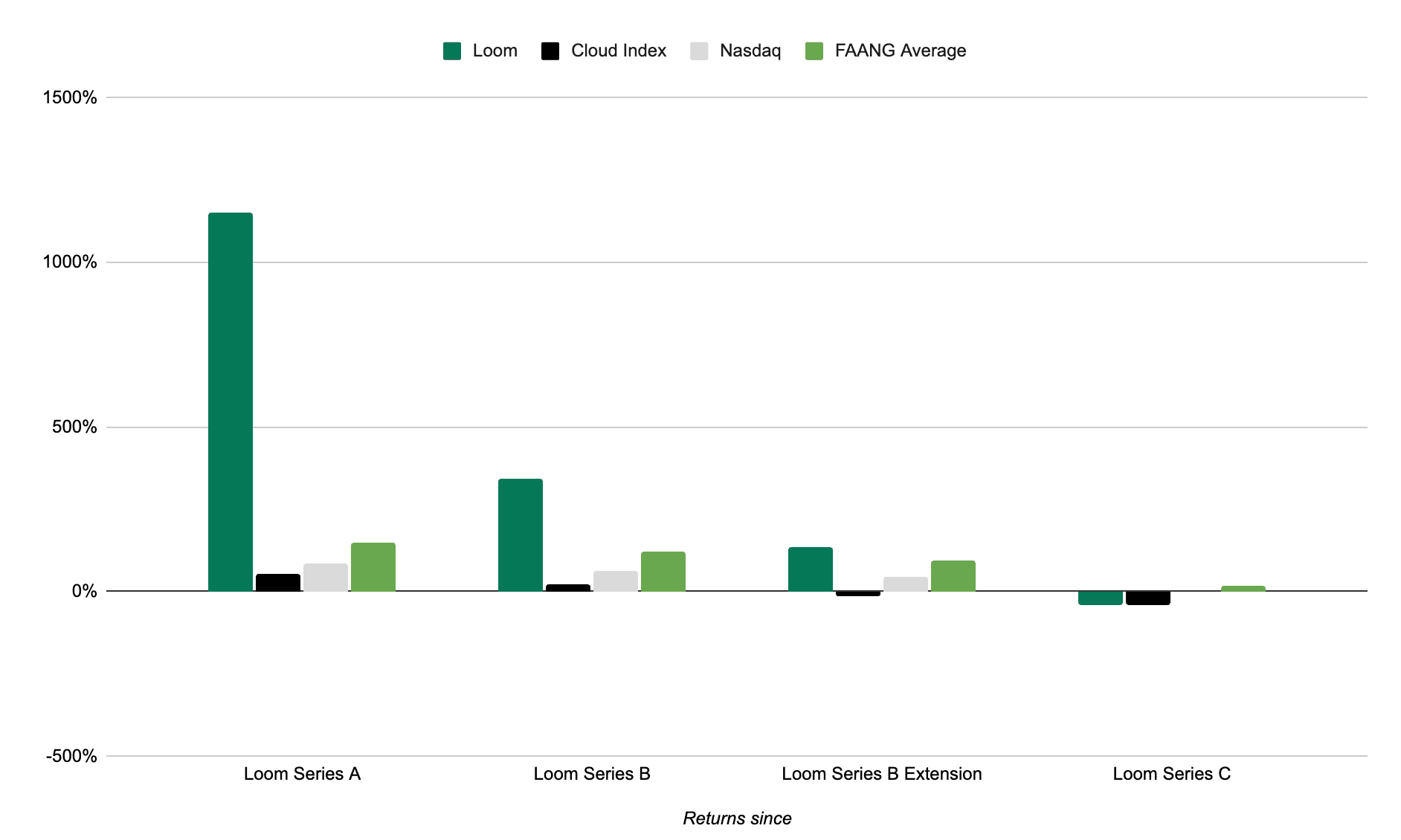

We wanted to answer one question: “Was joining Loom any better than joining FAANG, smaller public tech companies, or just getting paid purely in cash and investing in the public market?”

How we looked at the data: We looked round-by-round at how much Loom employees’ equity appreciated vs how much FAANG, the Nasdaq Composite Index, and the BVP Emerging Cloud Index (an index that tracks publicly-traded software companies like Shopify, Zoom, and Snowflake) appreciated over the same time period.

Here’s the data:

| Seed | Series A | Series B | Series B Extension | Series C | |

|---|---|---|---|---|---|

| Dates | May 2017 | November 2018 | October 2019 | May 2020 | May 2021 |

| Loom | 2403% | 1151% | 345% | 135% | -43% |

| Cloud Index | N/A | 54% | 24% | -16% | -40% |

| Nasdaq | 119% | 85% | 64% | 43% | -1% |

| Meta | 113% | 130% | 68% | 43% | -2% |

| Apple | 374% | 306% | 191% | 128% | 45% |

| Netflix | 122% | 26% | 26% | -14% | -28% |

| Microsoft | 374% | 199% | 131% | 81% | 33% |

| Alphabet | 182% | 151% | 121% | 94% | 18% |

Last time we looked at the numbers, we dove into Instacart’s IPO, which was depressing for startup folks. Anyone who joined Instacart after Series B (which is most of Instacart’s team!) would’ve seen a stronger return on their money if they’d just joined a FAANG company.

Loom is a totally different story. The company outperformed FAANG in everything but their 2021 Series C. Even the return from their Series C is in line with the BVP Emerging Cloud Index, which tracks companies like Shopify, Snowflake, and Zoom that Loom employees may have joined instead of Loom.

Given companies typically give significantly above-market offers at seed, A, and B to compensate for the risk, this likely dramatically understates how much better employees did at Loom than FAANG.

- • We used preferred price, not strike price, to calculate returns. The analysis here is not “what did employees return on the cash they paid to buy their equity” but rather “what did employees earn on their labor, which they could have traded for cash, FAANG stock, etc. and instead traded for Loom stock.”

- • We assumed a 1X liquidation preference for investors from the 2021 Series C, which valued Loom at more than Loom got acquired for.

- • Many growth stage companies issued employees equity at lower valuations than their latest round after the market downturn in 2022. If Loom did this, employees who joined after the Series C likely did better than we noted above. This info isn’t public, though, so it’s hard to say.

Loom vs the 2018 Series A Cohort

Of course, many employees at the earlier rounds were likely comparing Loom against other Series A and B startups rather than FAANG. It’s difficult to share tangible analysis on those startups because most are still private. While a few will outperform Loom, most will not achieve this strong a return.

We looked at 860 companies that raised a Series A in 2018.

Some of these companies like Miro, Chainalysis, and Anduril have been valued north of $8 billion in the private markets. We’ve rated a number of these companies on Prospect and believe their best days are ahead of them: Anduril (3X), Snyk (2X), Coalition (2X), VAST Data (2X), Flock Safety (2X), Verkada (2X), and Solugen (2X).

A few of these companies have gone public: Aurora, Faraday Future, GeneDx Holding, Aeva, SmartRent, Heliogen, Vicarious Surgical, and Energy Vault. All trade at a lower market cap than Loom’s $975M exit.

If we took the last private valuation of every company that raised a Series A in 2018 and marked it down by 40% to be in line with the Cloud Index to estimate what an exit would look like–likely a quite optimistic assumption for most given falling private valuations–Loom’s $975M exit would rank 33rd. I suspect as we see real returns in the coming years, Loom’s will place higher than 33rd, particularly when you factor in their timeline to exit.

In a word, there was never a “bad” time to join Loom. And, if you joined before Series C, you likely saw a life-changing return that you wouldn't have seen at FAANG or in the broader market.

What worked in Looms favor

• Timeline: Loom only took six and a half years from their first round of funding to their exit. Thus, even though the total size of Loom’s acquisition wasn’t as large as the market caps of the recent Klaviyo and Instacart IPOs, the shorter timeline to liquidity makes it a stronger return for employees than their alternatives.

• Reasonable valuations until 2021: VCs pre-2020 and 2021 were handing out more reasonable valuations, which means Loom wasn’t particularly overvalued until their final round of funding. There’s a bit of nuance required here, as employees want to join at low valuations then have subsequent rounds be at higher valuations to minimize dilution, but broadly speaking, the lower valuations were a good thing for Loom employees.

What worked against Loom

• A large, overvalued Series C: Loom’s $130M Series C in 2021 valued them at $1.5B, a valuation we can now say was too high. The market conditions in 2021 were giving astronomical valuations to plenty of startups, so this isn’t a problem unique to Loom. But, this valuation means that the equity outcome for people who joined Loom after their Series C weren’t as positive as they could have been.

• Liquidation preferences: Investors from that 2021 Series C likely got their money back before employees were paid out, so it’s more likely that the ‘real’ acquisition value for employees was closer to $845M.

The bottom line

Loom’s acquisition is an encouraging startup success story. It’s an interesting story in 2023 because despite not being a unicorn at exit, Loom created life changing wealth for most of its employees.

Finally, as we typically caveat with these analyses, there are important differences between being an investor and an employee. This analysis does not include the less-tangible benefits from joining a successful company like Loom. Employees who joined Loom across stages learned the right lessons from joining a successful startup, are part of a strong alumni network, and have a great logo on their resume. These things will help propel their startup careers forward.

Ready for your next big career move?

Prospect curates the most comprehensive list of top performing startups. Find the next Stripe, Airbnb, or Coinbase today.