Instacart's IPO a big win for early employees, but underperforms the market for most

Summer 2012. Two months late for Y Combinator and having already been rejected once, Instacart founder Apoorva Mehta threw a last-minute hail mary — he used his own product to send YC’s Garry Tan a six-pack of 21st Amendment Stout.

And it worked.

Yesterday, 11 years after that fateful beer delivery, Instacart went public: a new crowning achievement for the company. Mehta made millions, of course, as did early investors like Khosla Ventures and Sequoia Capital.

But what about the employees? How much would you have made if you joined Instacart? The outcomes are extremely divergent. Below, we’ll dive into the numbers.

Methodology

We looked longitudinally at job postings for senior engineers at the time period of each of Instacart’s funding rounds. By keeping position and level consistent, the only changing variable is the time at which the employee joined Instacart.

To get this data, we used the Internet Archive to find real job postings on Angellist, since those list equity ranges for positions. We then looked at data from Instacart’s S-1 and Pitchbook to estimate how much engineers made from Instacart’s IPO based on what funding round they joined in.

You can read the full methodology at the bottom of this post.

Massive returns for Series A & B

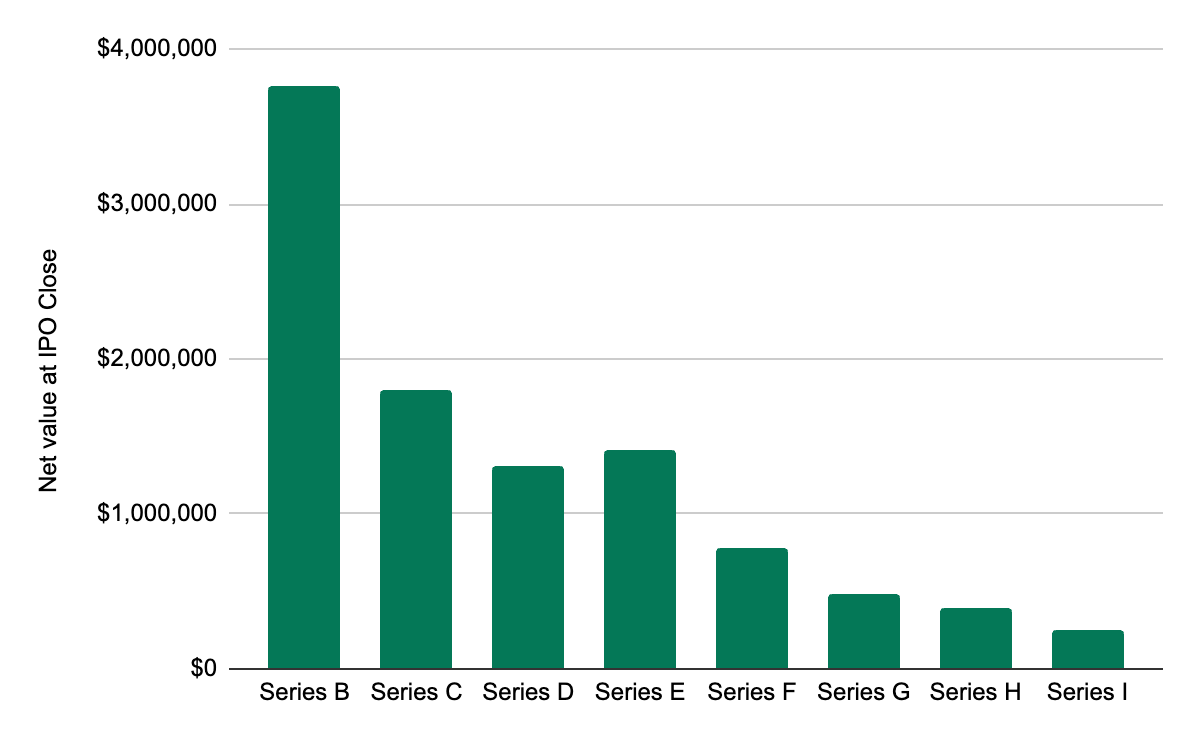

Here’s how much an engineer at the same level made from Instacart’s IPO depending on when they joined. People who joined before 2018 saw outstanding to modest gains:

| Series A | Series B | Series C | Series D | Series E | |

|---|---|---|---|---|---|

| Dates | July 2013 | June 2014 | Jan 2015 | March 2017 | April 2018 |

| Gross value at IPO close | $93,055,389 | $4,004,067 | $2,021,477 | $1,671,105 | $1,967,145 |

| Net value at IPO close | $93,027,776 | $3,766,437 | $1,794,136 | $1,308,123 | $1,409,690 |

| Gross value at time of grant | $657,186 | $354,069 | $798,393 | $918,364 | $1,173,866 |

| Return | 14060% | 1031% | 153% | 82% | 68% |

While those who joined more recently saw a serious dip in the value of their equity between when they joined and when Instacart went public:

| Series F | Series G | Series H | Series I | |

|---|---|---|---|---|

| Dates | Dec 2018 | July 2020 | Oct 2020 | Mar 2021 |

| Gross value at IPO close | $784,143 | $484,932 | $388,673 | $246,954 |

| Net value at IPO close | $784,143 | $484,932 | $388,673 | $246,954 |

| Gross value at time of grant | $692,000 | $692,000 | $692,000 | $916,000 |

| Return | 13% | -30% | -44% | -73% |

Joining at the Series A breaks any chart —as it results in unbelievably high gains — so let’s look at the distribution just from the Series B and on:

Returns lag alternatives from Series C onward

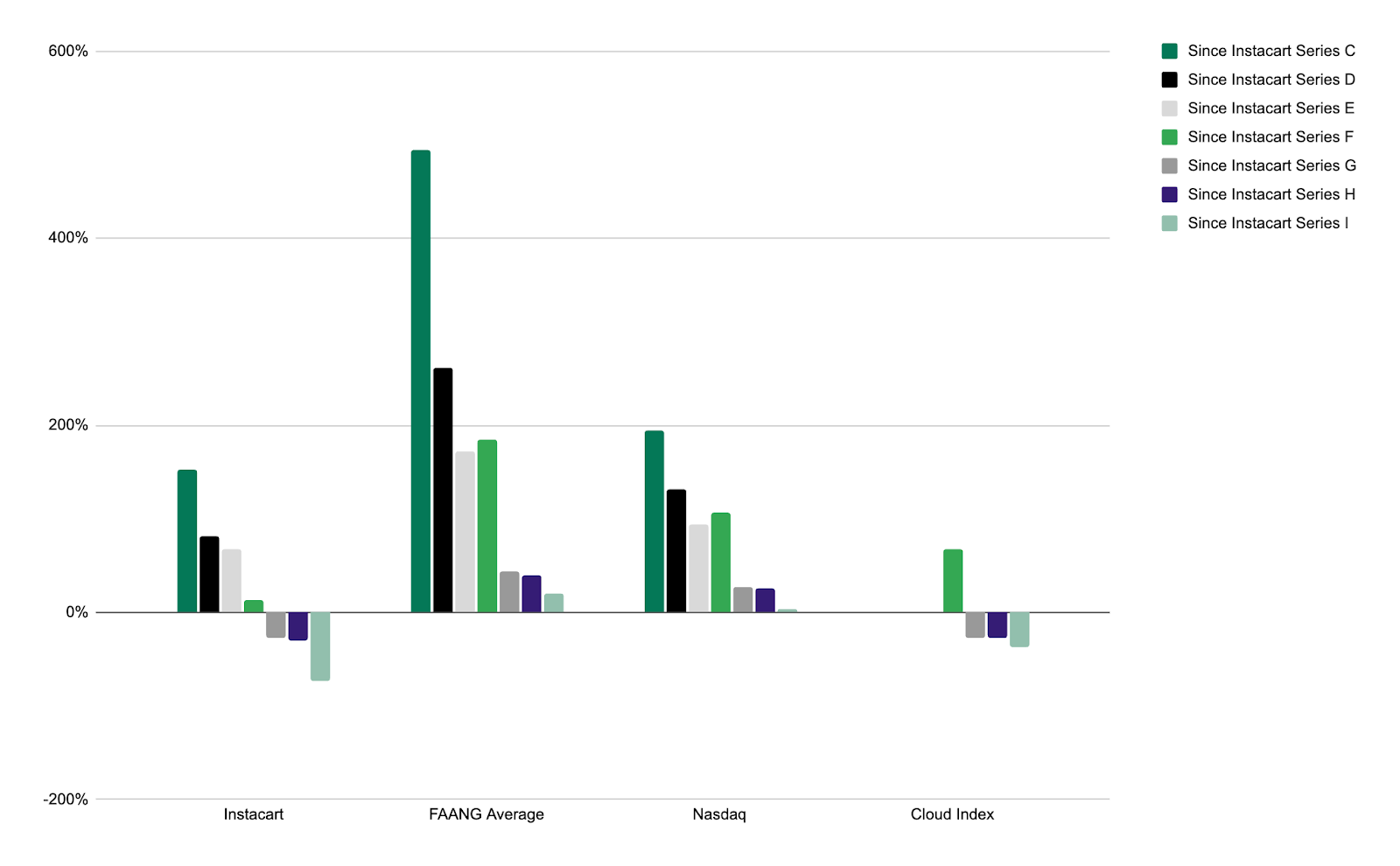

For employees joining at the growth stages, it’s important to consider their opportunity cost. Was joining Instacart any better than joining FAANG or getting paid in cash and investing in the market?

We looked round by round at how much Instacart employees’ equity appreciated vs how much FAANG, the Nasdaq Composite Index, and the BVP Emerging Cloud Index (an index that tracks publicly-traded software companies like Zoom, Square, Snowflake, and Dropbox) appreciated over the same time period.

| Series A | Series B | Series C | Series D | Series E | Series F | Series G | Series H | Series I | |

|---|---|---|---|---|---|---|---|---|---|

| Dates | July 2013 | June 2014 | Jan 2015 | March 2017 | April 2018 | Dec 2018 | July 2020 | Oct 2020 | Mar 2021 |

| Instacart | 13942% | 1031% | 153% | 82% | 68% | 13% | -27% | -30% | -73% |

| Meta | 542% | 353% | 302% | 115% | 77% | 133% | 20% | 16% | 4% |

| Apple | 973% | 671% | 511% | 399% | 333% | 354% | 69% | 64% | 47% |

| Netflix | 1027% | 529% | 528% | 168% | 27% | 48% | -19% | -17% | -24% |

| Microsoft | 939% | 688% | 713% | 399% | 251% | 224% | 60% | 62% | 39% |

| Alphabet | 509% | 372% | 414% | 226% | 171% | 164% | 86% | 71% | 34% |

| Nasdaq | 261% | 210% | 195% | 131% | 94% | 106% | 27% | 25% | 3% |

| Cloud Index | N/A | N/A | N/A | N/A | N/A | 68% | -27% | -27% | -37% |

After Instacart’s Series B, employees would have earned stronger returns joining FAANG or being paid in cash and putting that money into the market.

One important caveat here is that employees who joined during Instacart’s Series C-E rounds received larger equity grants than they likely would have received at public companies to compensate them for the risk they were taking. You can see this in the first table above. Given that FAANG appreciated 172% on average since the Series C while Instacart grew 68%, the appreciation in FAANG stock may have outweighed the larger size of Instacart’ employees initial grants. Once Instacart started issuing RSUs in early 2019, the size of employees’ grants likely converged toward market norms.

Takeaways

From a strictly returns perspective, those who joined Instacart early did extremely well — but it's under-appreciated just how early employees needed to join to earn outsized returns.

Though Instacart is a wildly successful startup that just pulled off one of the largest IPOs of the decade, joining after the Series B would’ve resulted in a smaller gain than if you had just been paid in cash and invested it in the market.

“It’s a classic example of people who invested in the seed round did extremely well,” Vinod Khosla, the venture capitalist who leads Khosla Ventures, recently told The Information. “The people who invested in the hype parts aren’t going to do as well if the hype doesn’t sustain.”

Instacart is over a decade old and built up lofty valuations in the private markets before going public. There are 25 other startups in the US that were valued north of $10B by private investors. Most were also founded a decade ago–an important factor when comparing employees’ alternative return options. Some will go public, some will be unable to do so. The public markets will show in the coming quarters whether Instacart was an outlier or the norm for this cohort of startups.

What this means if you’re looking for a startup job: Think like an investor and be cautious of entry prices. If you join a startup in the early stages, like Series A or B, you’re virtually guaranteed to make millions if the startup eventually goes public. If you join later, though, it’s worth doing some serious calculations to figure out what your equity may actually be worth in the long run.

Finally, there are important differences between being an investor and an employee. This analysis does not include the less-tangible benefits from joining a successful company like Instacart. Employees who joined Instacart across stages learned the right lessons from joining a successful startup, are part of a strong alumni network, and have a great logo on their resume. These things will help propel their startup careers forward.

Ready for your next big career move?

Prospect curates the most comprehensive list of top performing startups. Find the next Stripe, Airbnb, or Coinbase today.

Full Methodology

- • We left employees who joined in 2022 and 2023 out of the analysis given Instacart’s equity was repriced multiple times during this period and employees may have received additional equity to make them whole.

- • We assumed employees fully vested their initial four year equity grant and did not take refresh grants into account.

- • For the Series B-E job postings, we used the upper bound of the equity ranges listed on the job postings, as we think that’s the most accurate representation of what compensation employees would have actually accepted.

- • For the Series A job posting, the equity range was 0.15-5.0%. The upper bound of the range seemed quite high given our experience, so we used the midpoint 2.58%.

- • For the Series F-I jobs, we pulled an average of L5 and L6 engineers’ self-reported RSU packages from Levels.fyi.

- • Because it is impossible to know when employees exercised their options and when they sold, we’ve left taxes out of this analysis. Broadly speaking, factoring taxes into account would make the differences between early, middle, and late stage-joining employees even more stark. Early employees could be eligible for a QSBS exemption and pay no taxes on their first $10M in gains. Employees joining while Instacart issued options could be taxed at long term capital gains. Employees receiving RSUs would be taxed at ordinary income rates.

- • The exact job titles we used were: Lead Rails Engineer (Series A), Senior Rails Engineer (Series B-E), an average of L5 and L6 engineers (Series F-I).