Lower valuations make 2023 the best time to join a startup in years

Reading the tech news the past few months, you see stories of layoffs and plummeting valuations.

Despite this, now is the best time in at least the past five years to join a startup.

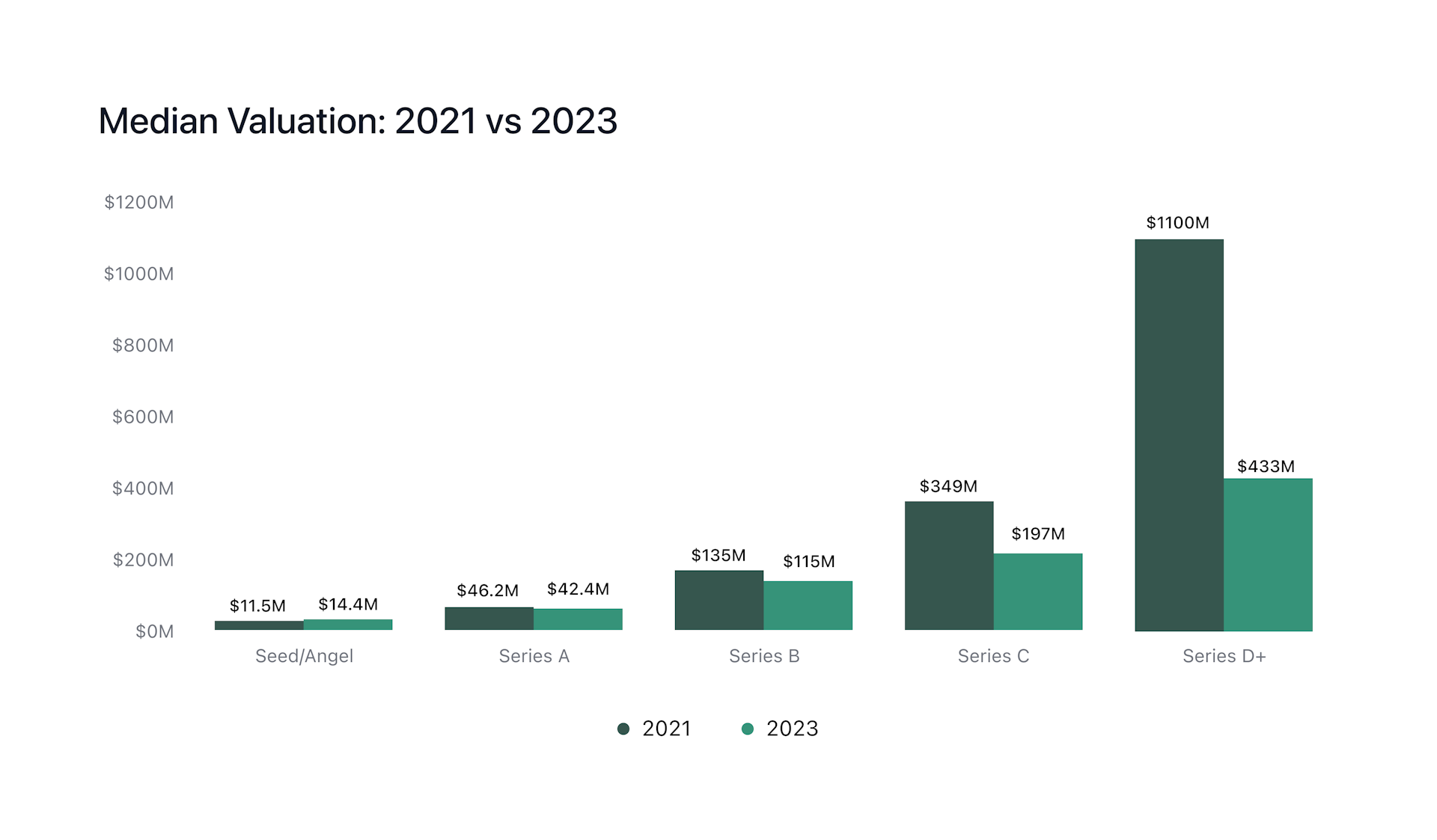

While most coverage has focused on low valuations being a bad thing for founders and existing employees, new employees joining a growth stage startup in 2023 could receive nearly three times the equity they would have received joining a similar stage startup in 2021.

Savvy job seekers will often look for companies with a low valuation (or avoid ones with a high valuation) so that their equity has more upside. They’ll wonder if they joined a unicorn “too late” or if there’s still upside between now and an IPO.

Investors say that entry prices matter. As an employee who owns equity (or options), you’re an investor, so they matter for you too.

Going beyond valuation: revenue multiples

Thinking like an investor, you should break valuation down into its component parts, revenue and revenue multiple:

This varies by stage and investor but is directionally accurate enough for our purposes.

In order for your equity to grow, the company’s valuation needs to increase. There are two drivers that change the value of your equity:

- Change in revenue

- Change in multiple

Revenue growth is fairly straightforward. Initially, the company has low revenue before it finds product-market fit (PMF). You receive more equity for joining at this stage to compensate you for the risk you’re taking. As the company finds PMF and starts scaling revenue, it is less risky to join and you receive less equity. Revenue growth can often seem more “fair”: grow revenue and you will grow valuation.

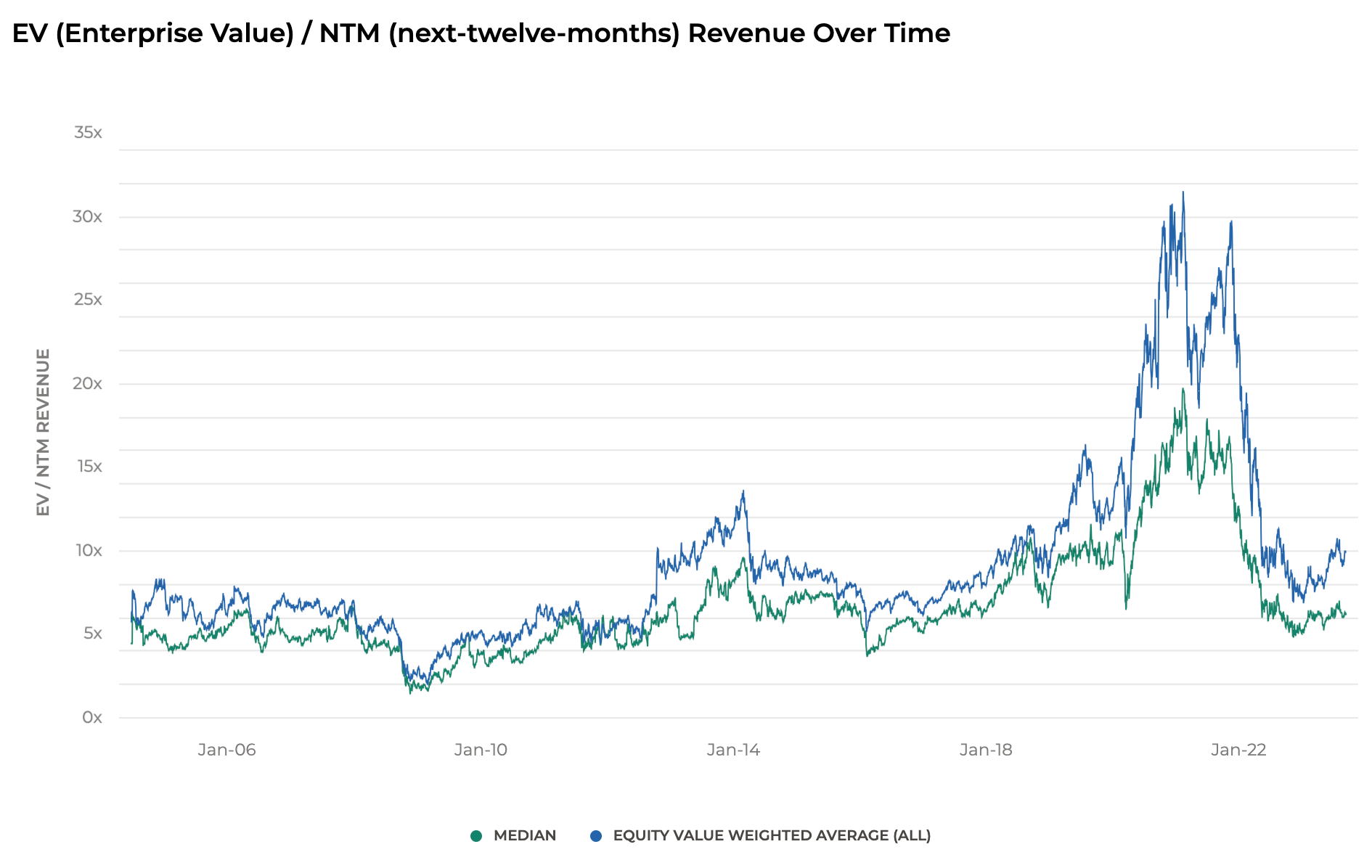

Multiple is a bit trickier, as it’s driven by the company’s growth rate (both present and long term), margins (again, current and long term), defensibility, comparisons to similar companies, and the market overall. A startup can control some of these factors, while others are entirely out of its hands. Typically, a startup’s multiple falls over time as its growth rate slows.

One simplified way to think about this is revenue growth is the performance of the business, while the multiple is the credit investors give the company for continuing that performance in the future.

Better entry prices for employees

What does this mean for you in 2023? Lower valuations are being driven by a market-wide correction away from unrealistic 2021 multiples toward more realistic multiples. This can mean dramatically better entry prices for employees at growth stage startups.

In 2021, investors valued businesses at 100 times their revenue; as an employee, you were issued equity at a price that would suggest the business was de-risked when it wasn’t.

Take Block (nee Square) as an example. Block raised a Series D valuing the company at $3.3B in 2012. Its valuation stayed at $3.3B until it raised again at a $6B valuation in 2015. During that time, the company grew it’s revenue 6X from $200M to $1.2B. Here is their revenue and multiple by year:

Because Block grew its revenue while its valuation stayed flat, employees received stock at a lower multiple in 2014 than 2012. They were buying into Block at the same entry price even though the business was in a much stronger position.

Another way to look at this is to hold Block’s multiple constant (say, 5X) and see what its valuation would have been at that multiple each year:

In 2015, Block raised at a $6B valuation then went public at a $2.9B valuation before growing considerably in the public markets. The company is worth $33B today. I used a now-public company as the example here to get accurate revenue information, but you could make similar charts today for OpenAI, Ramp, Mercury, and many others.

Long term opportunity

Of course, you don’t want to just get in at a good price, you want to exit and sell your stock at a good price as well.

Depending on the stage of the startup you choose to join, you could be holding your equity into the late 2020s or early 2030s. It’s difficult to predict what multiples will look like at that point, but you can build real value as an employee now and harvest it then.

Looking at multiples over the past two decades, we can see that 2020-2021 was an extreme aberration. It’s a fool's errand to think we’re returning to that. But if tech multiples return to the highs of 2014 or 2019, your equity will appreciate.

There is no guarantee that the startup you join today will grow revenue or maintain its multiple and exit at a higher valuation. In fact, many unicorns will fail to live up to their current valuations. While success isn’t guaranteed, there are ways to significantly increase your odds by putting your investor hat on.

First, don’t be scared off by the macro environment. Drill down into the components of valuation to see the opportunity. The multiple correction startups are going through right now makes this the best time to join a startup in years.

Second, move from the macro to the micro and pick the right company. I’ll write in the coming weeks about general principles for picking winning companies to work at. Until then, you can use Prospect to find the highest potential startups to commit your career to.