What pre-GPT unicorns are actually thriving? Hardware, fintech, and infrastructure dominate

What pre-GPT unicorns are actually thriving? Hardware, fintech, and infrastructure dominate

ChatGPT just turned three years old, and venture capitalists are continuing to pour cash into AI startups.

Dan Primack at Axios recently brought up a great point: how are VCs managing their pre-GPT investments?

I agree there isn’t enough discussion about this, so I decided to dig into the data. Before ChatGPT launched in November 2022, there were nearly a thousand VC-backed startups valued at more than a billion dollars. What are those startups doing now? How are they doing?

At Prospect, we help startup employees earn more from their equity, so naturally I gravitated toward looking at this through an employee-centric lens. Which pre-GPT unicorns are still worth joining and owning stock in? And what can we learn from the common patterns among those companies?

Below, I’ll aim to answer three questions:

- How have pre-GPT unicorns fared since ChatGPT’s release?

- Which pre-GPT unicorns have not pivoted to AI but are still thriving?

- Are companies actually being forced to ‘pivot to AI or perish’?

Question 1: How have pre-GPT unicorns fared since ChatGPT’s release?

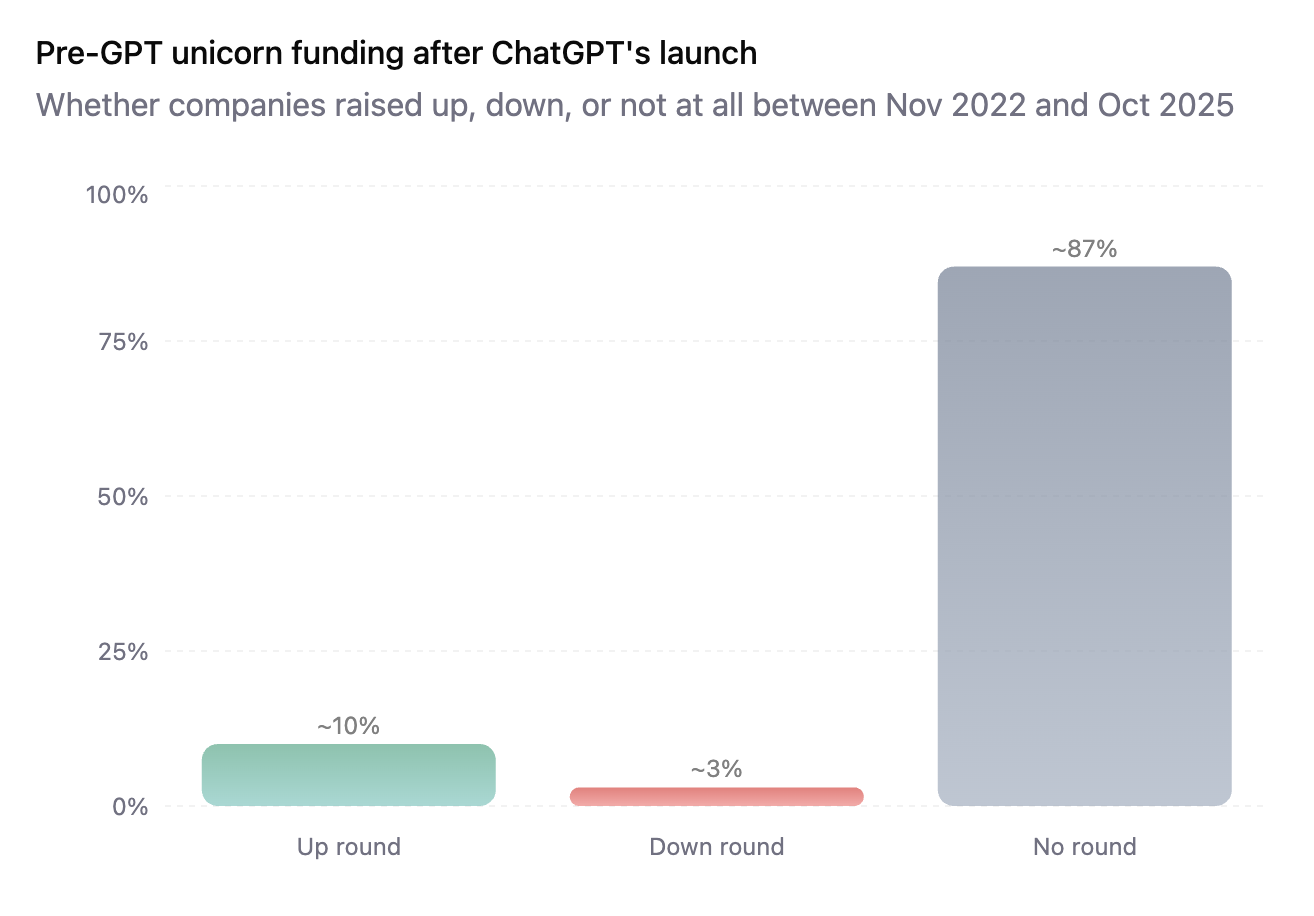

About 10% raised an up round, 3% raised a down round, and the rest didn’t close a formal round of VC funding between ChatGPT’s launch and November 2025.

Note: we included 8% of companies that have some record of a funding round occurring but no valuation details available in the no round category.

This isn’t particularly promising: the median time between startup raises is 2 to 3 years. Plenty of the familiar faces (the Ramps of the world) did raise an up round between 2022 and 2025—but the story is less optimistic for the 87% that did not.

It is hard to say just how much of this data is directly downstream of AI. Most startups that make it to later stages of funding (like Series E) do not have satisfying exits. And inflated ZIRP valuations may be more to blame than AI.

Still, it is fair to assume that the vast majority of pre-GPT unicorns are struggling more than you would expect them to struggle in a world without AI.

Question 2: Which pre-GPT startups have not pivoted to AI but are still thriving?

The majority of the pre-GPT unicorns that raised up rounds after ChatGPT’s release are not building AI products. And a significant percentage of them rank strongly in Prospect’s model on metrics like projected growth and investor quality.

We decided to build a short list, a cream of the crop of sorts, with the following criteria:

- Was a unicorn before ChatGPT’s release.

- Raised an up round between ChatGPT’s release and November 2025.

- Ranks in the top 20 percent of our model for expected valuation growth.

- Ranks in the top 20 percent of our model for investor quality.

- Ranks in the top 20 percent of headcount growth over the past 12 months.

- Is not primarily building an AI product

These criteria gave us the following list:

Financial and HR systems of record are deeply embedded and hard to replace. Infrastructure products and dev tools are in many ways downstream of the AI wave, as their revenues grow on the backs of their AI-native customers. Hardware companies like SpaceX, Neuralink, and Flock Safety are not immediately obvious targets for AI-forward competition.

Consumer-facing companies are an interesting standout, too. Whatnot and Wonder show up here, and both SKIMS and Vuori almost made the list. ChatGPT is good at a lot of things, but stitching together running pants and cooking meals are not two of those things. Yet.

We do not see a lot of SaaS. We don’t see a lot of software for marketing, revenue, or GTM folks. And to me, this makes sense: those are the kinds of products that are easier to replace and are perhaps lower hanging-fruit for a newer, AI-first company (like Clay) to come in and take over. Or perhaps, that’s at least what investors perceive.

Question 3: Are companies actually being forced to ‘pivot to AI or perish’?

If you’re finding it hard to raise money in today’s climate, the natural conclusion may be to pivot to AI. Many of the pre-GPT unicorns are now building a product that has something to do with AI. Very few of these companies were building AI before ChatGPT (save a few, like Anthropic).

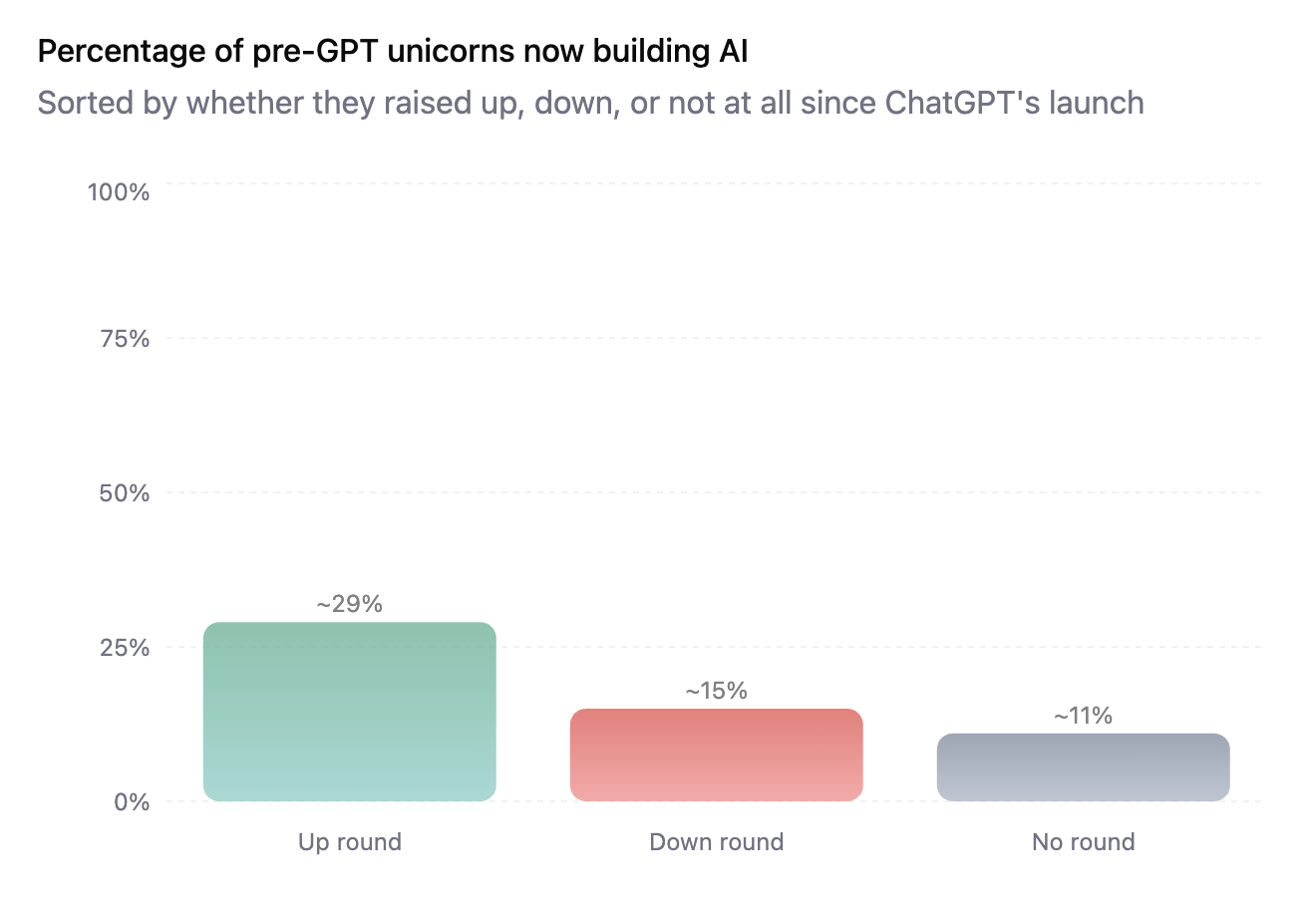

But is it working? I looked at the three buckets of pre-GPT unicorns—up round, down round, and no round—to see what percentage of companies in those categories are now building AI.

Here is what I found:

The companies that have been successful since ChatGPT’s launch are also more likely to be building AI than the companies that have raised down rounds or are otherwise stagnating.

It is also clear, though, that pivoting to AI is not a silver bullet to send a company’s valuation soaring. And the Occam’s Razor explanation is simply that some companies are far better than others at pivoting to AI-forward products. Successful companies may have made this shift naturally; perhaps, as Dan Primack mentions, it just makes their product better. Others may be pivoting in desperation—a play to raise necessary VC dollars or to fend off newer and better competition.

If you want to figure out which category a startup fits in (smart pivot or desperation pivot), the first thing you could do is what we’re doing here—look at the company’s most recent raise. Is their valuation climbing? Did Tier 1 investors lead their latest round? Or does momentum appear to be stalling?

You can also see what Prospect’s model thinks of their growth potential.