Why you should join Anrok

Introduction

The year is 2016.

You’re at the helm of a flourishing eCommerce venture. Sales are pouring in, and thanks to 1992’s Quill Corp. v. North Dakota, there’s no sales tax on the vast majority of your online transactions.

Life is good - it’s a lucrative time to be an online business.

But far from the high-tech hustle of Silicon Valley and nestled amongst the prairies of South Dakota, a storm is brewing — one that’s set to redefine online business and dramatically change the entire country’s tax code.

Background

In 2016, South Dakota Attorney General Marty Jackley helped introduce the South Dakota Sales Tax Fairness Act.

The goal of the law was simple: make it possible for South Dakota to tax online sales by expanding economic nexus principles to sales tax. This meant that a nexus was no longer just a concept limited to a physical relationship between business and state, but a connection that could now also be established by how much revenue or how many transactions were made in a given state. Crossing this nexus threshold would require online sellers to register and collect sales tax for South Dakota.

Until then, many online purchases in the U.S. didn't have sales tax thanks to the 1992 Supreme Court case Quill Corp. v. North Dakota. Quill essentially said only businesses with a physical presence in a state had to collect sales tax. Jackley's law aimed to change this: it allowed South Dakota to collect sales tax from online sellers even if they didn't have offices, warehouses, or salespeople in the state.

As anticipated, the law was met with significant resistance, particularly from online retail giants.

Wayfair, the online furniture and homegoods giant, disliked it enough that they took their objections to the Supreme Court.

But in the landmark 2018 decision South Dakota v. Wayfair, America’s highest court sided with South Dakota. This ruling overturned Quill's physical presence rule, enabling every state to establish their own sales tax nexus requirements, whether based on a company's physical location, the number of transactions, or the amount of sales revenue in a state.

By the following year, almost every single state had capitalized on this newfound latitude, enacting laws that defined their own economic nexus criteria. Almost overnight, a complex labyrinth of approximately 10,000 different tax rates across 45 states and Washington D.C. was now relevant to remote sellers that previously weren’t subject to states' physical nexuses but now had tax obligations due to the economic nexuses, turning sales tax compliance into a logistical nightmare for software companies and other online sellers.

In New York, electronically downloaded software and SaaS became taxable whereas digital books and other digital goods didn’t. In Colorado, the exact opposite was true. In California, you had to pay sales tax if a California business even referred a customer to your site.

Across the country, sales tax compliance went from a non-issue to a pressing concern that had finance departments of all sizes on high alert.

Enter: Anrok

Miles away in the heart of Silicon Valley, far removed from the changes taking place in South Dakota, Michelle Valentine was working on developer products and never imagined she’d worry about the intricacies of state sales tax rates and economic nexuses.

But one morning, while on a run with a friend who headed the financial department of a tech firm, Michelle heard about the mounting stress caused by the new, complex landscape of sales tax compliance. Intrigued but alarmed for her friend, she began to check in with other colleagues and contacts.

It quickly became clear that this wasn't just one company's problem; it was an industry-wide crisis that had finance departments scrambling to adapt.

Realizing the urgency and scale of the issue, Michelle saw a clear opportunity.

She and her teammate Kannan left their lucrative jobs to tackle the growing problem head-on. Together, they founded Anrok, a startup designed to navigate the labyrinthine world of sales tax compliance that had become a nightmare for businesses across the country.

The product

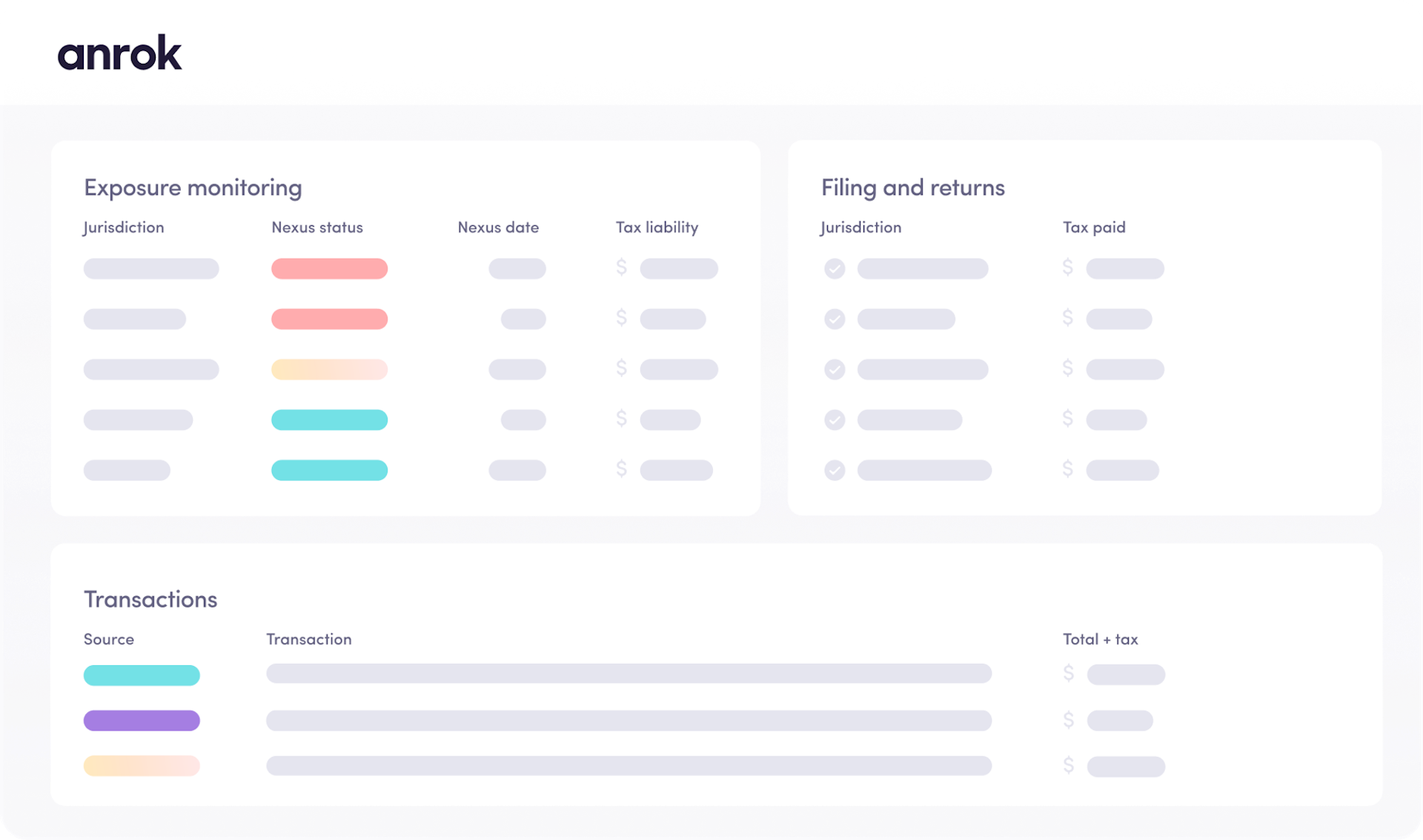

Anrok offers an end-to-end sales tax compliance platform, making it easy for any startup to navigate the increasingly intricate landscape of local sales tax compliance.

Beyond helping you manage existing sales taxes, Anrok goes a step further and also helps you avoid triggering future sales taxes through smart notifications about potential new tax obligations.

More concretely, Anrok’s offers three major value propositions:

Comprehensive Monitoring

- • Centralized Monitoring: Gain full visibility into existing tax exposure—regionally, nationally, and even internationally—in one place.

- • One-Click Registration: Simplify your legal obligations with quick registration options. In the U.S., Anrok handles this for free, even in complex jurisdictions like home-rule cities that have their own tax codes.

Smart Tracking and Notifications

- • Employee Impact: Keep tabs on how your remote workforce affects your sales tax liability.

- • Real-Time Alerts: Stay ahead of the curve with smart notifications on when new tax obligations arise, such as when hiring remote employees.

Effortless Connection

- • No-Code Integrations: Jumpstart your compliance journey with easy import features for transactions and employee locations. Seamlessly map your products to the correct tax codes.

- • Integrated Billing: Anrok works in tandem with your existing billing and payment platforms to calculate precise sales tax during checkout or invoice generation.

Instead of hiring an expensive accounting firm or juggling all 10,000 sales tax rates in-house, startups now had an easy and affordable way to manage and optimize their taxes.

The product was a gamechanger, and proved highly popular with founders.

Traction

In their funding announcement, Anrok revealed that they’d grown revenue more than sevenfold between 2020 and 2021. Additionally, they reported having over 100 customers, a number that’s likely increased significantly since. Just two years after launch, their clients already include major companies like Anthropic, Front, Vanta, Gem, Productboard, AgentSync, Sense, Persona, Pave, Statsig, and Notion.

On the back of all this growth, they’ve raised over $24M from Sequoia Capital and Index Ventures, who co-led both their Seed and Series A rounds.

Business Model

The company offers two main plans with a flat monthly rate.

The Starter Plan: $499/ month

- • Global exposure monitoring, tax calculation, filing and remittance, and exemption certificates

- • Sales tax calculator

- • No-code integrations with popular billing systems such as Quickbooks, Stripe, Xero, and Chargebee.

- • For teams that are distributed, the Starter Plan also offers physical nexus tracking through integrations with Rippling, Gusto, BambooHR, and more.

The Core Plan: $999 per month

- • Everything in the Starter Plan

- • Global exposure modeling tool, ongoing tax and compliance support

- • Integrations with NetSuite and Salesforce

- • Support for multiple entities

- • API technical consultations

Market Sizing

Every SaaS merchant grapples with these new sales tax regulations, meaning every SaaS company is a potential Anrok customer.

That’s a lot of potential customers.

Today, there are over 18,000 SaaS companies operating within the U.S., the average of which serves 36,000 customers. These figures are set to rise: by 2028, the global SaaS market is projected to soar to $716.52 billion, expanding at a CAGR of 27.5%. In the U.S. alone, SaaS revenue is expected to reach $118.10 billion in 2022 and surge to $167.30 billion by 2027, with a CAGR of 7.21%.

Many of these companies would find Anrok useful: monitoring and identifying sales tax alone costs an estimated $1,740 and 16 hours per month. There is room for Anrok to solve more sales tax problems and grow their annual contract values. Businesses spend an average of 147 hours and over $14,000 per month on the full span of sales tax compliance (including filing, accounting, remittance), with 21% reporting expenditures exceeding $50,000. SMBs typically employ two to five people to manage this.

Given the ongoing complexities of tax regulations, companies are spending an average of 250 hours a year researching tax updates.

Anrok would automate all of this, enabling founders to spend more time on their own products and businesses.

Working at Anrok

Anrok's success is understandable when you consider the caliber of their team.

Michelle Valentine

- Michelle was previously a Product Manager at Airtable and an investor at Index Ventures. Earlier in her career, she worked in Investment Banking at Goldman Sachs and graduated from Stanford University.

Kannan Goundan

- Kannan was previously a Software Engineer at early Airtable and a Software Engineer at early Dropbox. Earlier in his career, he dropped out of UCLA’s Computer Science PhD program. He holds a BS in CS from UCSC.

Brad Silicani

- Brad was previously the Treasurer at Dropbox where he worked for nearly a decade alongside Kannan. Before that, he was employed at accounting firm Ernst & Young. He holds a BS and MS in Accounting from the University of Southern California.

Tahirih Skolnik

- Tahirih was previously an Enterprise Sales Manager at Figma and an Account Executive at Square. She holds a BS from Columbia University.

Devon Watts

- Devon was previously the VP of Marketing at Groundspeed Analytics and before that, the Senior Director of Marketing at Carta. Earlier in her career, she was the Head of Product Marketing & Content at Asana and a Product Marketing Manager at Microsoft. She holds a degree in Anthropology from Princeton University.

Gordon Worley

- Gordon previously served as a Senior Software Engineer at Plaid and was the Head of SRE at AdStage. Earlier in his career, he was a Software Engineer at Korrelate. He earned both his BS and MS in Computer Science from the University of Central Florida

Benefits & Culture Highlight

- • Employees can choose between remote work or collaborating at the San Francisco HQ

- • Company-wide winter break

- • Annual learning and development stipend

- • Quarterly team-wide offsite

Key Risks & Opportunities

Anrok’s biggest opportunity lies in how they stand to index all of SaaS growth.

Every SaaS company, regardless of size, has to deal with the United States’ enormously complex web of 10,000 codes across 45 states. Anrok is well positioned to solve the new customer pain created by this regulatory change.

We’ve seen this story before: Oscar Health did extremely well by launching shortly after the passage of the Affordable Care Act.

Nonetheless, Anrok is far from the only contender in the space. Major players include:

Tax Firms

Large Tax Consultancies: Many companies burdened with substantial sales tax compliance challenges typically turn to renowned tax firms for solutions. Notable names include Deloitte, KPMG, Ernst & Young, and PwC.

CPAs and Groups: Smaller businesses often favor CPAs or consortiums of them. These options, while more tailored to smaller operations, can be on the pricier side. Additionally, they generally offer services aligned with the tax collection period, rather than continuous compliance management.

Startups - The tax compliance landscape has recently been invigorated by emerging startups, each bringing unique value propositions.

Zamp is strategically targeting e-commerce, with a specialized API for platforms like Shopify and Amazon. Their investors include Valor Equity Partners, Soma Capital, and Day One Ventures.

Quaderno has been noted for its premium pricing, which might be a barrier for some businesses. They were recently acquired by Visma, a Norwegian software company.

Big Tech

Stripe: Without a doubt, Stripe stands out as a heavyweight in the industry. After its acquisition of TaxJar, it fortified its position in the tax compliance landscape.

However, Stripe Tax only handles transactions processed through its own platform. This limitation might not be ideal for burgeoning startups with layered financial operations. Such companies frequently employ a range of payment systems—ACH, Stripe, and occasionally Braintree being among the top choices.

Additionally, these startups might lean on subscription management tools such as Chargebee, Chargify, or SaaSOptics to cater to more intricate subscription models. Given this intricate web of financial transactions, a comprehensive solution like Anrok can prove invaluable.

Thomson Reuters’ ONESOURCE Indirect Tax: This is a seasoned solution that has been catering to the needs of various businesses, ensuring they remain compliant with indirect tax requirements.

Conclusion

The golden age of tax-free e-commerce might never come back, but staying compliant doesn’t have to be a nightmare.

Anrok is helping SaaS companies everywhere track, manage, and optimize their sales tax exposure.

They’re growing fast and hiring Software Engineers, Account Executives, and Growth Professionals.