Introducing Prospect: Manage your startup equity like a VC

When Jane joined Anduril in 2020, it was far from a sure thing. Despite being valued at $1.9 billion and backed by Founders Fund, the company was just 4 years old. Palantir hadn’t gone public yet and defense tech was ignored by most VCs. As part of her compensation, she received stock options in the company that cost $225,000 to exercise. Working on a startup salary, she watched her cash closely; plus, she wasn’t sure how to weigh the risk-reward of investing cash in an illiquid startup. So she put her head down and worked. Today, Anduril is worth over $30 billion. Jane’s equity stake is worth millions, but her tax bill has ballooned to $2.4 million; with a bit better planning, she could’ve earned an extra $2 million.

The stakes for startup employees have never been higher: choose the right company, exercise your options, and create generational wealth. Or spend a fortune exercising options in a seemingly stable unicorn, only for the value to vanish overnight.

That’s why we’re launching Prospect Equity: powerful, customized option exercise and stock sale strategies to help startup employees earn more from their equity.

Startups are staying private for far longer, often indefinitely, while the variance of their outcomes is widening rapidly; so employees now regularly need to buy and sell highly volatile, illiquid private stocks. Star companies are valued at $10B less than three years after launching. Seven private companies are worth over $100B. At the same time, once-hot AI startups and formerly high-flying unicorns are being shut down, sold for parts, and seeing their founders depart for bigger paychecks. This all happens on accelerated timelines, increasing the urgency and difficulty for startup employees to make the right moves.

When I started my career as a VC at Khosla Ventures, it was my full time job to think deeply about what a startup may be worth in the future, and how we should manage our private stock. Then I joined Rippling, where my teammates and I were paid partially in equity. We weren’t professional investors, but we had to manage our own private equity portfolios on top of our day jobs. At Rippling, we were asking the same fundamental questions I asked at Khosla, but with far less time and expertise.

As we grew from 30 people in a dingy office in the Mission to thousands of employees in a gleaming new high rise, I had countless conversations with candidates as I attempted to explain the value of Rippling stock: the likely range of outcomes for the company, the mechanics of how their options worked, and why joining Rippling was better than staying at Google.

As my friends and I vested, we navigated new questions:

- - Should I exercise my options?

- - How can I afford the taxes on them?

- - What the hell is an AMT credit?

- - How do I forecast my tax burden on RSUs when they eventually get released?

- - Should I sell in the tender to buy a house or leave my money growing in the company? What will I do if the opportunities to sell dry up?

I came to think of startup employee equity as the largest and worst run fund in the world.

Non-professional managers busy with taxing day jobs managing concentrated portfolios in risky, illiquid stocks. It’s crazy! It would be tempting to say we should throw this whole rat's nest of problems in the trash and just pay employees in cash, as Sam Lessin has argued. But it’s so important to get this right.

Equity aligns incentives, making employees true owners in the business. Broad employee ownership is the most important cultural artifact in Silicon Valley. It has changed my life. It has changed millions of other employees’ lives, and it should change millions of employees’ lives in the years to come. We just need the right tools for employees to realize their equity’s value.

I started Prospect to help startup employees earn more from their equity and build the tools I wish I’d had, from powerful option exercise and stock sale strategies to finding the best startup jobs.

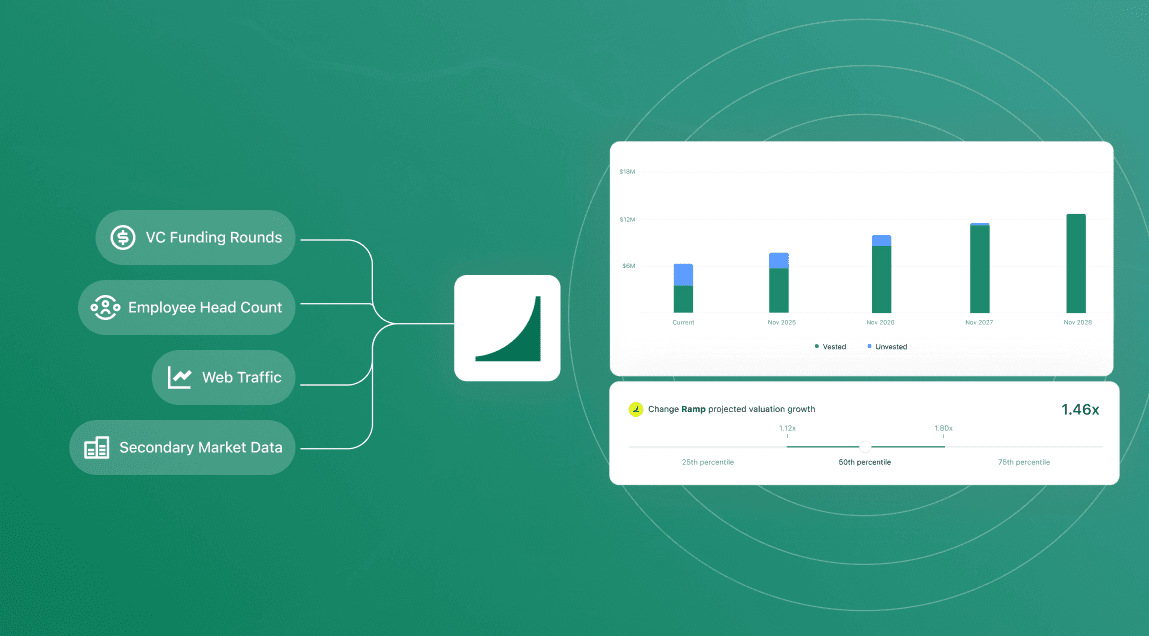

Our machine learning model uses the same data top investors rely on: funding rounds, LinkedIn data, web traffic, and secondary market prices to project the most likely range of outcomes for any startup’s equity.

Until now, you had to fumble around in the dark with homegrown spreadsheets. You had to take a crack at projecting the company’s growth, which is a VC’s full time job. You had to understand and model complex tax calculations, which is a CPA’s full time job. Then you had to stack this wobbly tower of assumptions, decide to exercise or sell, and hope for the best. As one of our users put it, it’s “amateur hour for a multi-million dollar decision.”

The consequences of mismanagement can be severe. One employee early exercised his options in Ramp but forgot to file an 83(b) election–a decision that will cost him over $1 million.

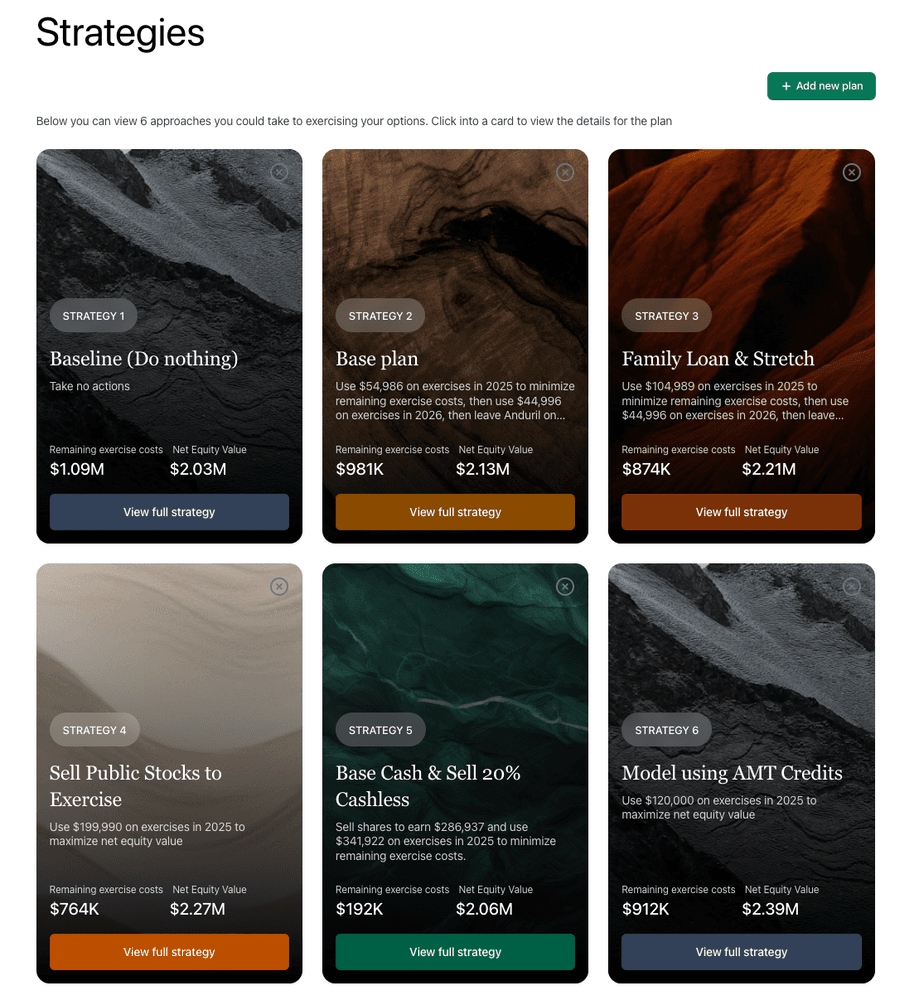

Prospect combines our projections with your equity holdings, tax, and financial info, and instantly builds you customized multi-year option exercise and stock sale strategies. What was once guesswork now gets appropriate rigor, as Prospect frames the ROI of any action you take with your equity.

Prospect answers all of the questions that have been lingering in the back of your mind:

- - What is this company actually worth?

- - Could I be making more somewhere else?

- - Is now the right time to sell?

Prospect puts a venture capitalist, accountant, and career coach into your pocket, working 24/7 for you to earn more from your equity. Use Prospect to make sure you sell at the best prices, lose less to taxes, and work at the best companies.

We built these tools for ourselves and our friends. Over the past few months, we’ve helped hundreds of employees at top companies like Anduril, Rippling, Ramp, Mercor, and Anthropic manage their equity.

One of our earliest users graduated from college and immediately joined Ramp as a software engineer. Four years flew by, and he started using Prospect to build an option exercise strategy that met his goals, financial constraints, and risk tolerance. Racing against the clock of a rising Fair Market Value (FMV), he fully exercised his last option days before the FMV jumped, and saved $853K on his option exercise taxes.

On average, our clients are $173,000 better off because they spent 10 minutes uploading their docs to Prospect. For most employees, that's about a year’s salary for less time than you spent last night on Reddit. We think that's a pretty good ROI.

I remember exactly where I was (standing over a dresser I’d stacked books on to build a makeshift desk during Covid, talking through a new partnership opportunity with teammates) when I found out Rippling was a unicorn. It was a magical moment: the hard work and risk paid off and my paper stock was actually going to be worth something. (Note: I was actually probably wrong here, and the equity only truly became worth something when I was able to sell it in a tender a couple years later. But nevertheless!)

We’re in a thrilling new era of wealth creation. Employees are working as hard as ever. I’m excited to live in a world where they earn as much as possible from taking risks and working hard to earn equity. Startup employees should have the same tools available to them that publicly-traded stock holders have. They should be able to sell their equity when they need liquidity, lend against their stock (with appropriate guardrails), minimize their tax burdens, invest in other promising companies, and work at the highest potential companies.

The future is here. It’s not evenly distributed. At Prospect, we work every day to help employees choose the best companies and make the right plans with their equity.

You can sign up today. We look forward to helping you earn more from your equity.